1H26 result – receiver driven

HCW announced its 1H26 result with FFO / share of 2.2c above BPe (+3%), but below Visible Alpha consensus (-13%). No FY26 guidance remains given ongoing Healthscope (“HSO”) receiver-led process, but it is expected that “HCW and UHF will recommence distributions once the HSO situation has been resolved”. Key takeouts included:

(1) HSO situation; incremental alternate arrangement detail – All 11 HSO hospitals continue to operate as normal, with 100% of all rent due having been paid, and state-by-state executable lease agreements with alternate operators remains in place as per prior. Incrementally though, HCW now expects upon new leases being struck the terms would include face rents to remain unchanged and incentives would indicatively result in a 10-15% near-term reduction to asset values.

(2) c.$155m cash & undrawn debt position post disposals – 6 primary medical assets were sold during the half (all settled) for c.$77m total at 6.25% in-place yield (BPe) which while marginally dilutive to earnings and NTA ($81m book val), provide HCW with a stronger cash position to fund potential lease arrangement outcomes with gearing of 28.5% below 30-40% target range.

(3) Timing the key question – The HSO receiver-led process remains the key determinant in potential pathways head, particularly in regards to UHF equity investment and HCW distribution’s recommencing (BPe 1QFY27).

Earnings changes

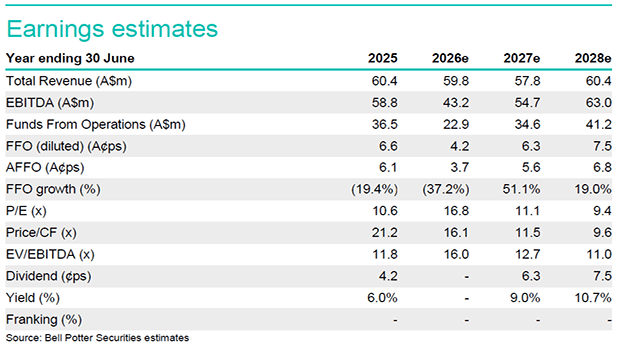

We decrease our FY26-28 FFO / share estimates by -19% to +1% to reflect: (1) asset disposals during 1H26; (2) impact of half year actuals; and (3) more conservative stance on recommencement of UHF distribution (now end 1Q27 vs. end FY26 prior).

Investment thesis: Buy

No change to our Buy rating. HCW trades at a material -50% discount to NTA which is the widest in our sector coverage, notwithstanding +26bp cap rate expansion at the result (c.+40bps for HSO-tenant assets) and additional detail on potential asset devaluations which implies a higher valuation than the current share price implied.