Strategic stake in DEG pays off.

Northern Star Resources Ltd (NST, Buy, TP$19.55ps) and DeGrey Mining Ltd (DEG, Buy Spec, Val$2.15ps, pre-offer) announced that they had agreed that NST would acquire DEG by Scheme of Arrangement (the Scheme). Under the terms of the allscrip Scheme, shareholders would receive 0.119 new NST shares for each DEG share. The Scheme requires 75% shareholder approval (meeting expected in April 2025). GOR is the largest shareholder in DEG, holding 414m shares (17.3%, undiluted basis). Under the Scheme, at NST’s last closing price ($16.59ps), the implied offer price for DEG is $1.97ps (vs the headline number of $2.08ps), and the implied value of GOR’s interest is $815m (vs an estimated acquisition cost of $414m). If the Scheme completes as presented, we estimate that GOR would own ~3.4% of NST.

GOR’s intentions absent in the Scheme announcement.

GOR is yet to respond to the Scheme announcement, despite, we expect, being invited to support, and commit to the Scheme. We think that GOR is generally supportive of a change of control transaction for DEG, given recent commentary. However, it makes sense for them to wait to see if a superior proposal emerges. We expect the inclusion of a cash component would better serve GOR’s interests. But if no superior proposal was to emerge, the Scheme would be a great outcome for GOR.

Investment view: Buy. TP$2.55ps (prev. $2.40ps).

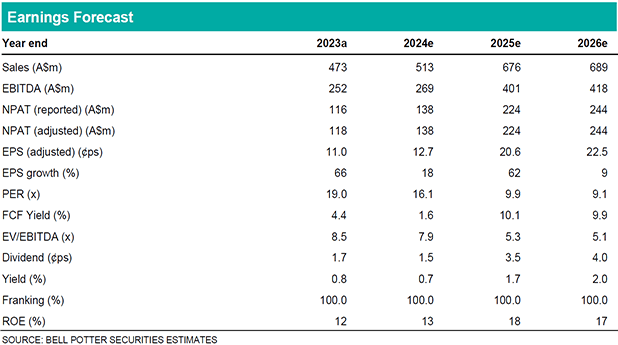

We update our valuation to reflect the Scheme, marking-to-market the value of the DEG shareholding. While it’s not possible to accurately estimate GOR’s final exit price from an all-scrip Scheme, on last closing prices, we estimate net proceeds for GOR of ~$700m (65cps), which could be returned to shareholders, or used to finance growth. On the operational front, we expect a strong 4Q for GOR given: (1) gold production of ~90koz given a return to full high-grade plant feed, (2) sold into a >A$4,000/oz gold price, (3) reported with CY25 gold production guidance of ~350koz, and (4) GOR has underperformed the S&P/ASX All Ordinaries Gold Index (XGD) for the last 12-months.