Iron ore price higher for longer

We have reviewed our earnings forecasts for FMG in light of higher-than-forecast iron ore prices, which we increase by 4% for FY23 on a marked-to-market basis. We also further tighten our price realisation discounts due to good demand in the market for mid-grade iron ore products and an increasing contribution from Iron Bridge, which produces a high grade magnetite concentrate. Seaborne iron ore prices have been stronger in response to Chinese Government stimulus including certain interest rate cuts and less restrictive housing policies. However, downstream demand continues to remain weak and as a result market sentiment is mixed. Reflecting this, we have lifted our short term iron ore price assumptions but our medium and longer term price forecasts remain unchanged on a steadily declining trajectory towards US$90/t nominal (US$82/t real) in FY25.

Iron Bridge into the mix

We also reduce the risk adjustment discount that we apply to the Iron Bridge Magnetite Project (FMG 69% ownership) which commenced production earlier in the June 2023 quarter and is currently ramping up production to a nameplate run-rate of ~22Mtpa of ~67% Fe grade magnetite concentrate. As this high grade production ramps up we expect it to provide FMG with both marketing and strategic optionality, enabling it to maximise value over its entire iron ore product suite.

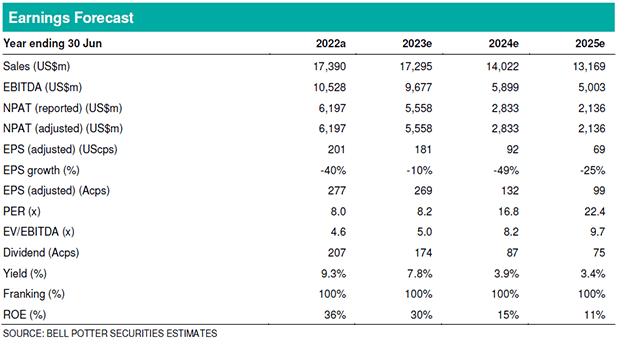

Investment thesis – Sell TP$15.16/sh (Sell TP$14.45/sh)

EPS changes in this report are: FY23 +16%, FY24 +1%, FY25 +0%. Our NPV-based valuation increases 5% to $15.16/sh on our 4% higher FY23 iron ore price and derisked valuation for Iron Bridge. While operations continue to perform at the top end of expectations, a forecast decline in iron ore prices, earnings and dividends combined with the uncertainty over capital allocation and investment returns for both FFI and the Belinga project in Gabon, causes us to see limited upside from the current share price. We retain our Sell recommendation.