The hacking of 130 high-profile Twitter accounts on Wednesday 15 July is a reminder of the growing importance of cybersecurity in the new digital age. Verified accounts including Jeff Bezos, Bill Gates, Elon Musk, and Barack Obama were targeted and used to post a scam seeking to lure followers into sending Bitcoin to the perpetrators. The majority of companies that are more vulnerable than a US$28bn social networking giant need to take notice. Working from home may increase the likelihood of a cyber breach for many companies, as employees are often working with less than optimal software and using unsecured forms of communication. According to PwC’s Global Economic Crime and Fraud Survey 2020, cybercrime is the second most frequent incident of fraud.

It is not just companies that are expected to increase spending in this area. On 30 June 2020, Prime Minister Scott Morrison announced a plan for the nation’s largest ever investment in cybersecurity; A$1.35bn and over 500 new jobs over the next decade to enhance the cyber security capabilities. The 2019 US President’s Budget included a US$15bn budget for cybersecurity-related activities.

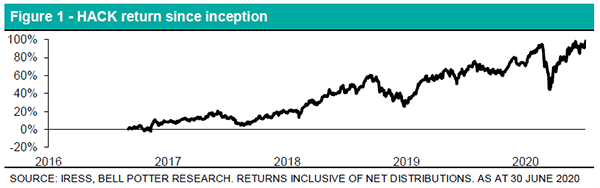

BetaShares Global Cybersecurity ETF (HACK)

BetaShares Global Cybersecurity ETF (HACK) provides exposure to a diversified portfolio of the largest leading and emerging cybersecurity companies in the world. HACK provides a simple and cost-effective method to gain exposure to the rapidly growing global cybersecurity sector. HACK aims to track the performance of the Nasdaq Consumer Technology Association Cybersecurity Index (before fees and expenses). The index provides exposure to the leading companies in the global cybersecurity sector. The Fund’s portfolio is made up of large and emerging leading global cybersecurity companies from around the world.

About the index

The Index includes cybersecurity companies in the technology and industrial sectors. These are companies primarily involved in the building, implementation and management of security protocols applied to private and public networks, computers, and mobile devices to provide protection of the integrity of data and network operations.

Domestic Equity ETFs

Small caps lagged the broad market in June as the markets were led by the banks. VanEck Vectors Australian Banks ETF (MVB) was the top performing domestic focused ETF with a return of 5.7%. MVB aims to track the performance of the largest and most liquid ASX-listed companies that generate at least 50% of their revenues or assets from the Australian banking sector. MVB had returned -20.3% year-to-date at the end of June. BetaShares Australian Ex-20 Portfolio Diversifier ETF (EX20), which aims to diversify away from the domestic banks and resources, returned 1.0% for the month compared to a 3.4% return in iShares S&P/ASX 20 ETF (ILC).

Whilst the BetaShares S&P/ASX Australian Technology ETF (ATEC) didn’t provide the extreme positive returns experienced in the two previous month, a 5.2% return in June was enough to ensure that ATEC was the top performing domestic ETF for the June quarter with 47.0%. As at 16 July, ATEC includes 50 securities with Afterpay Limited (APT) the largest weighting with 17.1%. The S&P/ASX All Technology Index rebalances quarterly. The next rebalance date will be the third Friday of September. Each Index constituent has a float adjusted market capitalisation weight cap of 25%.

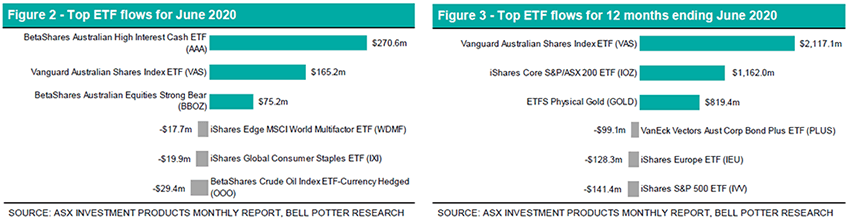

Vanguard Australian Shares Index ETF (VAS) and BetaShares Australian Equities Strong Bear Hedge Fund (BBOZ) received the largest net fund inflows over the month with $165.2m and $75.2m, respectively. Total FUM is increasing back towards the all-time high. Minimal net outflows were recorded in June.

BBOZ delivered the lowest return in the month with -9.8%. The high level of net inflows is an indication on the market sentiment of investors at these levels. BBOZ is a geared fund, designed to generate magnified positive returns when the market goes down (and vice versa). The strategy aims to provide the return on a given day basis and due to the effects of rebalancing and compounding of investment returns this may not be reflected in periods longer than a given day.

Global Equity ETFs

After the negative net flows in March, global equity ETFs received net inflows over $1.3bn during the June quarter. iShares Core MSCI World All Cap (AUD Hedged) ETF (IHWL) led the inflows in June with $52.1m, followed by BetaShares U.S. Equities Strong Bear Hedge Fund – Currency Hedged (BBUS) with $42.6m despite having the lowest return. Like with the domestic equity ETFs, investors have shown the caution with large inflows into funds that benefit from negative market returns. Montaka Global Extension Fund – Quoted Managed Hedged Fund (MKAX), which listed in June, added $32.3m of FUM to the sector. MKAX is an actively managed fund that seeks to invest in high-quality global companies. The fund will typically hold 15 to 30 long positions and partially offsets these with 10 to 40 short positions.

The top performing global equity ETF in June was the BetaShares Asia Technology Tigers ETF (ASIA) with 10.5%. ASIA aims to track the performance of the Solactive Asia Ex – Japan Technology & Internet Tigers Index (before fees and expenses) comprising the 50 largest technology and online retail stocks in Asia (ex-Japan). The Index is predominately weighted towards China (~55%) and Taiwan (~20%). ASIA provided unitholders with a net return of 47.4% over FY20. VanEck Vectors China New Economy ETF (CNEW) returned 9.8% for another strong month. CNEW provides an alternative equity exposure to China compared to other China and Asian exposed ETFs. It gives investors a portfolio with the best growth prospects in sectors making up ‘the New Economy’, namely technology, health care, consumer staples and consumer discretionary.

Outside of BBUS, Vanguard Global Infrastructure Index ETF (VBLD) was the lowest performing ETF for the month with a -6.3% return. VBLD seeks to track the return of the FTSE Developed Core Infrastructure Index (with net dividends reinvested) in Australian dollars (before fees, expenses, and tax). The Index is heavily weight towards the US with a 66.6% weight at the end of June.

Fixed Interest ETFs

Domestic fixed interest ETFs strengthened with net inflows of $493m, an increase of ~$360m. After leading net outflows in the previous month with -$56m, BetaShares Australian High Interest Cash ETF (AAA) recorded net inflows of $270 .6m. AAA aims to provide monthly income distributions that exceed the 30 Bank Bill Swap Rate (BBSW) (after fees and expenses). The interest rate earned on Fund’s bank deposits, net of management costs, was 0.67% as at 17 July 2020.

Global fixed interest ETFs recorded returned to positive net flows with $33m. This was after three consecutive months of net outflows.

Commodity & Currency ETFs

Total net inflows for Commodities have now decreased from the prior month for three consecutive months. ETFS Physical Gold (GOLD) and Perth Mint Gold (PMGOLD) received the majority of the net inflows with ~$75m and ~$25m in June. Investors continue to add gold as a market and inflation hedge. ETFS Physical Palladium (ETPMPD), which had strengthened over 2019 on an increase in demand and supply shortages has returned 1.1% year-to-date and was down 26.7% over the June quarter. BetaShares Crude Oil Index ETF – Currency Hedged (Synthetic) (OOO) was the top performing fund of the group. We continue to express caution in investing in OOO as the futures exposure that OOO aims to provide to unitholders is now at the discretion of the fund provider until further notice. OOO has effectively become an actively managed fund as the underlying exposure has been subject to extreme volatility in 2020.