… a drone wall descends across Europe

EU Defence Commissioner Andrius Kubilius says the bloc will build a “drone wall” along the eastern flank, integrating detection, tracking and interception to counter hostile UAVs. After recent airspace violations, EU defence ministers agreed to move from “discussion to concrete action”, with a shared drone-detection network targeted within about a year, followed by deeper layers over time. Further details are expected at early-October EU meetings in Copenhagen and Brussels.

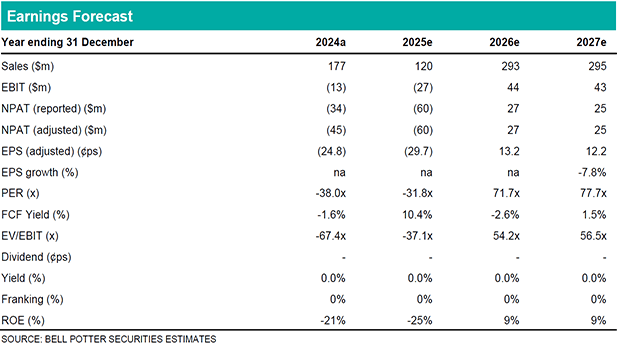

Contract signings delayed; revenue deferred

EOS has provided CY25e revenue guidance of $115-125m, lower than BPe of $166m and an updated contract backlog of $299m as of 29 September 2025. The weaker than expected guidance reflects delayed signing of orders from the previously expected 3Q25 signing out to 4Q25 or 2026 and hence pushing revenue into 2026. EOS has identified an additional $25m of revenue which may fall into 2025 if orders are signed in sufficient time to enable delivery in 2025. In addition, EOS disclosed a new ~$20m “advanced opportunity” to sell RWS to a European customer to be delivered within the next 6 months.

EPS changes

We have deferred $46m of CY25e revenue into CY26e ($36m) and CY27e ($10m), culminating in a CY25e EPS loss of 30c (prev. 17c) and EPS upgrades of 94% and 12% in CY26/27e respectively. We upgrade our TP reflecting a higher CY26e EV/EBITDA multiple due to strengthened confidence in longer term revenue growth.

Investment View: Retain Buy, $11.00 PT (prev. $5.70)

EOS is positioned as a market leader in counter-UAS solutions, in particular directed energy, and is fully leveraged to increases in defence budgets globally magnified by higher spending allocations to counter-drone technology. The EU “drone wall” is one such example underscoring the critical need for counter-UAS. We see positive news flow over the next 6 months stemming from counter-UAS and RWS contract awards.