Lockdowns have consequences too

Contract awards fall off a cliff in April

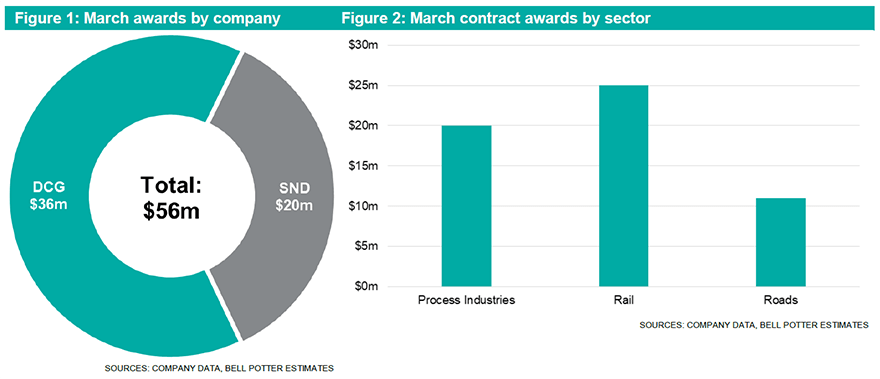

A total of $56m of new contracts were announced during April, representing a 90% fall from the $543m announced during March. This comes on the back of a highly uncertain economic outlook, and lockdown measures forcing companies to turn their focus away from growth projects.

Producers announce delays and deferrals

Coinciding with the sharp decline in new project awards, has been a swift response from Resources companies to the current economic turmoil and its impact upon commodity prices. While Oil & Gas producers have announced the sharpest cuts, producers across most commodities have announced or at least communicated that material cuts will eventuate.

While many of these cuts have occurred as a result of social distancing requirements (particularly on offshore Oil & Gas rigs), more longer lasting deferrals will take place as a result of potentially very challenging economic conditions. This is to occur across both new construction projects, and maintenance and shutdown activity.

Margins likely to be impacted across our E&C index

In addition to the outlook for Resources work declining significantly, contractors are likely to see their margins materially impacted. This comes as travel restrictions and social distancing requirements cause material operational disruption. A reduction in available work may also result in the tendering environment reversing its recent stabilisation and instead see it become increasingly competitive.

Share market bounces, but don’t expect V-shaped recovery

With the share market continuing its rally off of its March lows, it appears that market participants are going to temporarily ignore upcoming economic data and instead price in a V-shaped recovery. This may result in share markets continuing their rally in the near-term.

Though we believe that sporadic economic re-openings, a decline in productivity and an increase in balance sheet leverage put hopes of a strong bounce back in economic activity at risk, leading to an elevated potential for share markets to test their March lows.

Long-term focus, balance sheet health are necessities

While extraordinary levels of fiscal and monetary stimulus will continue to cause financial market inflation and provide support for asset prices, we believe that a deterioration in underlying economic fundamentals means that betting on a sustained short-term rebound remains fraught with risk.

Investors should thus approach any investments within our E&C index with a long-term mindset, and focus on firms with strong balance sheets (which generally includes a solid net cash position), track record of project delivery and free cash flow generation.

This is important, because the E&C sector was already not sustainable before the current economic crisis. Any prolonged economic downturn will thus likely see some E&C companies fight for survival.