Increases interest in BYD retail joint venture

Eagers announced it has increased its interest in EV Dealer Group Pty Ltd – the national retail joint venture for BYD – from 49% to 80% effective today. The additional 31% interest was acquired from EVDirect.com for total consideration of $70m comprising $50m in cash and $20m in Eagers shares. EVDirect.com retains a 20% interest in the retail JV and also holds the exclusive distribution rights for BYD in Australia. Eagers said the increased interest strengthens its position as the exclusive retail partner for BYD and EVDirect.com in the Australian market and further demonstrates its unique positioning as a leader in the transition to new energy and low emission vehicles.

Modest EPS upgrades

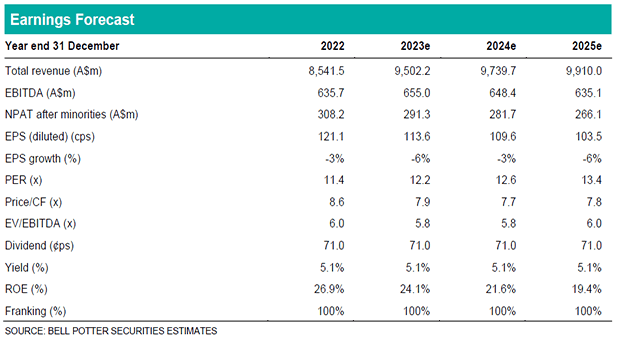

We have updated our forecasts for the increased stake in the BYD retail JV but there is no change in our underlying forecasts. Eagers already consolidates the JV – despite only originally having a 49% interest – so the only change is in the minority interest and NPAT after minorities. There is, therefore, no change in our revenue or underlying operating PBT forecasts but there is modest upgrades in our EPS forecasts of 2%, 3% and 5% in 2023, 2024 and 2025. Note we continue to forecast 2023 revenue of $9.5bn which is consistent with the guidance of b/w $9.5-10.0bn and believe the key swing factor in this range is the level of revenue from the BYD JV.

Investment view: PT up 1% to $15.15, Maintain BUY

We have updated each valuation used in the determination of our price target for the earnings changes as well as market movements and time creep. We have also updated the valuations for the recently announced stake in McMillan Shakespeare though this has no impact on our forecasts. We continue to apply flat multiples of 12.5x and 6.0x in the PE ratio and EV/EBITDA valuations and a WACC of 8.9% in the DCF. The net result is a modest 1% increase in our PT to $15.15 which equates to a total expected return of approximately 15% so we maintain our BUY recommendation.