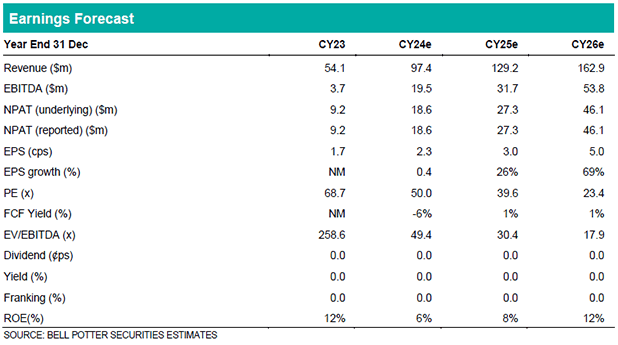

Bottom-line earnings miss to BPe

DRO recorded revenue from customers of $23.3m (+106% vs pcp) during the 1H24, -3% below BP estimates. Gross margin (71.6%) was largely in-line with BPe however opex (-$22.7m) was materially greater than our estimates (-$18.5m) and was the primary reason for the miss at the bottom line. This included share-based payment expenses of -$2.7 million, an increase of 207% relative to 1H23 of -$0.8m. DRO recorded EBITDA of -$5.2m (vs BPe -$1.1m) and a net loss after tax of -$4.8m (vs BPe -$1.6m), excluding the share-based payment expense the net loss after tax was $2.1m. The company had a cash balance of $230m as of 23-Aug-24, with no core debt or convertibles.

Focus remains on 2H

The company entered the 2H with a contracted backlog of $32m and sales pipeline of $1.1b, including 33 projects valued over $5m each and the largest valued at $213m. We remain confident the company will deliver a significantly improved 2H performance based on 1) the significant level of inventory on hand to facilitate rapid fulfilment, 2) the historical seasonality of the business with >80% of CY23 revenue recorded in the 2H and 3) numerous near-term sales opportunities, including recently announced military aid packages (see previous report 22-Jul-24).

Investment View: 8% increase in PT to $1.35

We have made no changes to our revenue forecasts at this stage, whilst we have made minor changes to operating expenses, cash flows and working capital in-line with today’s result. Our EPS changes are -6% and +2% in CY24 and CY25, respectively. We have reassessed our valuation assumptions and determined they are overly conservative considering the well capitalised balance sheet (we made no changes post the recent capital raise) and the recent re-rating of mid-cap defence peers. As such, we have increased the multiples we apply in our EV/EBITDA and PE valuations to 26x and 36x, respectively. The net result is an 8% increase in our PT to $1.35, which is >15% premium to the share price so we retain our buy recommendation.