Behring to continue the heavy lifting

CSL is a global biotechnology company holding the #1 or #2 position in its three key markets: (1) plasma-derived therapies (Behring), (2) flu vaccines (Seqirus) and (3) iron products (Vifor). Behring is CSL’s largest division (72% of revenue) and we expect it will continue to do the heavy lifting in the near-term, both in topline growth and margin expansion. CSL’s FY25 revenue guidance of 5%-7% (BPe 6.5%) is comprised of “high single digit” growth for Behring and “flattish” growth for Seqirus and Vifor. Behring’s more favourable outlook, coupled with its gross margin recovery to pre-pandemic levels (which we expect in FY28), results in confidence that CSL will be able to achieve its guidance of “annual double-digit earnings growth” over the mid-term, despite more challenging near-term prospects for Seqirus and Vifor.

Double-digit mid-term earnings growth, as per guidance

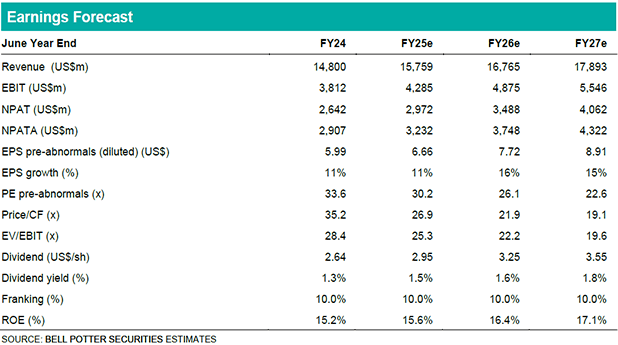

For FY25, our NPATA forecast of US$3.28b at CC (or US$3.23b on a reported basis) is toward the top end of the US$3.2b-$3.3b CC guidance range. We incorporate the guided $50m FX headwind into our reported figure. Looking to the mid-term, we expect NPATA to grow at a 3-year CAGR of 14% from FY25 to FY27 (VA cons also 14%). The double-digit earnings growth outlook is driven by Behring’s margin recovery despite the near-term headwinds facing Vifor (generic iron competition) and Seqirus (lower flu vaccine demand), which together represent only 28% of CSL revenue.

Investment view: Initiate with BUY; $345.00 PT

Our price target for CSL is $345 which is determined through a combination of DCF and PE ratio methodologies. The PT is a 15% premium to the current share price and combined with the expected dividend yield of 1.5%, results in a total expected return of 16%. This is greater than 15% hence we initiate with a BUY recommendation. In our view the stock looks undervalued on a PE ratio 18%/8% below 5yr/10yr historical averages and is set for double-digit earnings growth driven by the core Behring division. Short-term catalysts include the R&D investor update on 22 October and potential garadacimab HAE approval in the current quarter.