Capital raising and drivers

We update our forecasts for CBO’s recent capital raising, investment in US orchards and movements in input costs.

US orchard development: CBO recently announced a $183m capital raising to fund the development of a further 1,600Ha of orchards in the US. In aggregate, CBO is targeting the planting of 2,580Ha over FY26-28e, lifting company oil production from ~0.5mL to ~9ml at maturity (c2035). Our forecasts have been updated to incorporate additional US plantings in FY27-28e, resulting in near term EPS dilution.

Input cost pressures: YTD VWAP water allocations trades on the Goulburn and VIC Murray systems are up +99% YOY to $268/ML and compares to CBO’s FY25 average cost of $139/ML. Dec’25 averages are in the region of $275/ML. Fertiliser and crop protection values are demonstrating modest YOY inflation as indicated by recent cost comments at SHV’s FY25 result.

Pricing indicators: Landed EU inventories continue to land at lower values, down -41% YOY to a 30-month low (on a R3MA basis). We noted AGM comments that group packaged goods NSR was slightly higher YOY in 1Q26. At the same time we also note that an analysis of advertised selling prices for CBO and Spanish SKU’s in Woolworths and Coles (~68% of FY25 Australian sales), highlights increased levels of promotional activity during 1H26e relative to 2H25 (See Fig.7-12 on page 3).

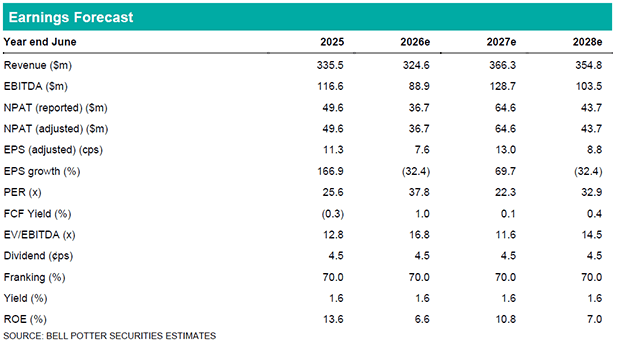

EPS changes are -3% in FY26e, -2% in FY27e and -6% in FY28e and reflect lower third-party US volumes, expanded orchard development, changes to orchard depreciation, higher crop growing costs in Australia and the dilutionary impact of the recent equity raise. Our target price is unchanged at $2.90ps, with near term dilution mitigated by upgraded US orchard NPV’s.

Investment view: Hold rating unchanged

There is no change to our Hold rating. While offering ~10% EPS CAGR to FY28e (on a R24M basis), CBO trades at ~32x FY26e EPS (R24MA basis). This multiple vs. growth equation does not stand out as relative value in the sector.