High grade iron concentrates to enable greener steel

CIA’s 100%-owned Bloom Lake mine in northern Quebec Canada produces around 15Mtpa of high grade (+66% Fe) iron concentrate. This high grade concentrate reduces steel making carbon emissions by around 10% compared with typical hematite ore. From 2026, processing plant upgrades will lift around half of CIA’s production to 69% Fe. At this “DR-grade” level, CIA’s concentrates can supply Direct Reduction Iron – Electric Arc Furnace steel producers, reducing carbon emissions by 2-7x compared with traditional blast furnace methods. An upgrade to blend all of Bloom Lake’s production to DR-grade is a potential next step.

Capturing high grade premiums; potential to partner

High grade iron concentrates trade at material premiums to the 62% Fe iron ore index. Over the last two years, CIA’s gross realised price has averaged around US$15/t higher than the 62% index. DR-grade concentrate could fetch a further premium of around US$25/t. At present, these premiums relate to higher value-in-use. With carbon emission policies becoming more acute (e.g. the EU Carbon Border Adjustment Mechanism), these premiums will likely expand to capture emission reduction economic benefits. CIA is also progressing the Kami Project, nearby to Bloom Lake, through a feasibility study and a partnering process. The Kami prefeasibility study (January 2024) outlined potential for a further 9Mtpa of DR-grade production.

Investment view – Buy, Target Price $7.15/sh

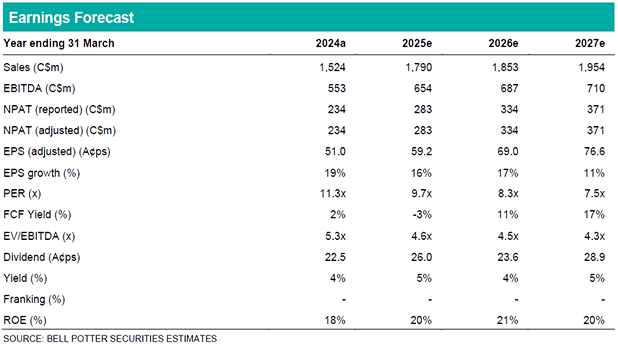

The shift into higher grade production will likely support average realised prices and earnings amid an iron ore price environment generally expected to weaken. However, there is the potential for a positive iron ore price response with typical seasonal activity (Q1 2025). CIA will benefit from maturing higher-grade iron concentrate markets which recognise emission reduction benefits. Government policy will be increasingly supportive of processes which assist decarbonising the hard-to-abate steel sector. CIA is a dividend payer; we expect earnings to continue to support dividends.