Australian Gold Producer breathing life into historic mines.

CYL is an Australian gold production and development company with operations in Western Australia and Tasmania. CYL owns three gold processing plants (two at the Plutonic Gold Operation in WA, and one at the Henty Gold Operation in Tasmania), has Mineral Resources of 3.6Moz and Ore Reserves of 1.0Moz. CYL’s exploration tenements at the Bendigo Gold Project in Victoria cover 75 kilometres of strike along the Whitelaw and Tandarra Faults north of Bendigo and in other areas north of the Fosterville and Inglewood gold fields.

The 3-year plan: Phase 2 complete; on to Phase 3.

In FY24, the company successfully completed the turnaround of the Plutonic Gold Operation (PGO), with a 46% increase in gold production, and a 66% increase in Ore Reserves, following the consolidation of the Plutonic-Marymia Gold Belt in FY23. Signalling the next phase of strategy execution, from CY25, CYL will continue growing the value of the PGO by commencing three new satellite mines and focusing on organic growth. The company has outlined its plans to (1) utilise latent processing capacity at PGO (increasing throughput from 1.2Mtpa to 1.8Mtpa), (2) develop satellite mines at Plutonic East, Trident and K2, and (3) test the significant residual prospectivity of known deposits and the 40km long strike of the Plutonic-Marymia Gold Belt within its tenement package. The plan outlines how CYL will grow group gold production from 110koz in FY24 to ~200koz in FY27 through doubling gold production at PGO.

Investment view: initiate with a BUY, TP$3.90ps.

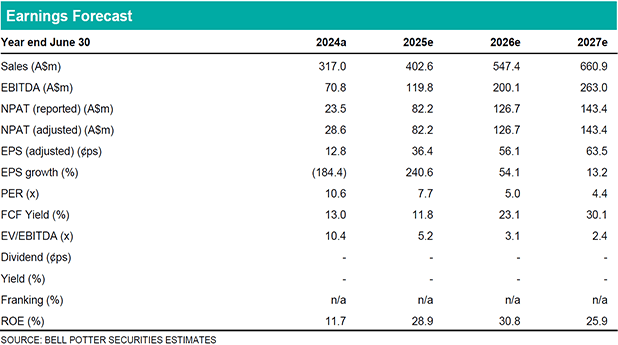

Our NPV based valuation references CYL’s 3-year Plan and Ore Reserves. Our NPV based valuations account for $2.86ps, or ~75%, of our Target Price. There is good potential for further significant discoveries at PGO from extensions of known deposits and across the greater belt. Discovery and Reserve growth will catalyse the share price as the markets perception of CYL is enhanced, Plutonic is derisked, mine-lives extended, and increased valuations supported.