The Green Revolution

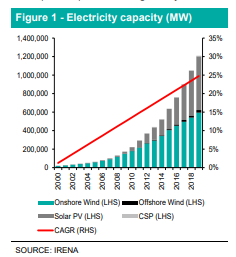

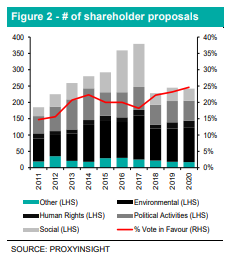

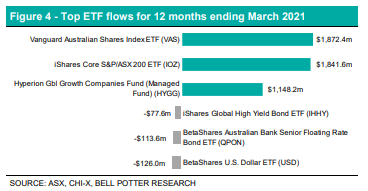

Environmental, Social and Governance (ESG) issues are showing an increasing impact on Australian investors with the number of designated responsible ETFs surging 77.8% YoY as at 31st March 2021. While this provides the opportunity to align investments with intrinsic values, investors can now gain direct access to the net zero initiative via VanEck Vectors Global Clean Energy ETF (CLNE) and BetaShares Climate Change Innovation ETF (ERTH) (continued on pg. 2&3). Shareholder engagement and activism in climate related proposals continues to rise with greater support. 61 meetings were convened last year with 105 proposals on environmental matters. Expansionary monetary stimulus, regulatory frameworks, political agendas and technological innovation also continues to drive down the cost of capital for carbon-conscious projects, fostering affordability and competitiveness within clean energies. We calculate a compounded annual growth rate (CAGR) of 24.7%, globally, for renewable electricity capacities this century.

Authored by Hayden Nicholson, ETF / LIC Specialist at Bell Potter Securities, 27 April 2021