No change in forecasts

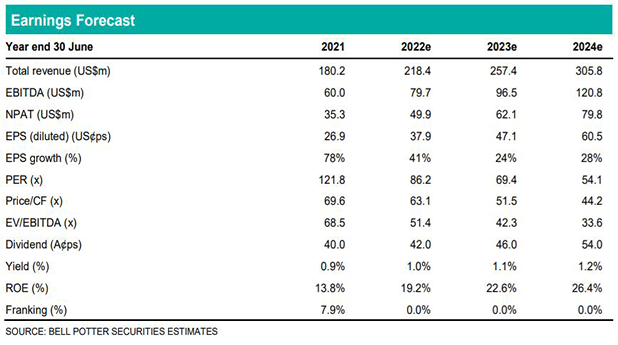

There is no change in our forecasts for Altium which we last updated in early November. We continue to forecast FY22 revenue and EBITDA of US$218m and US$80m which is at the top end or slightly higher than the guidance ranges of US$209-217m and US$72-80m. We also continue to see some prospect of an upgrade to the guidance at the release of the 1HFY22 result in February especially after the company said at the AGM that it is “confident that it is not likely to be at the low end of the guidance range”. We then forecast continued strong revenue growth in the high teen percentages in FY23 and FY24 and then >20% EBITDA growth in each period on the back of anticipated further margin expansion.

6% increase in PT to $45.00

While there is no change in our forecasts we have updated each valuation used in the determination of our price target for market movements and time creep. We have also increased the premium we apply in the relative valuations from 20% to 25% given the prospect, as mentioned, of an upgrade to the FY22 guidance at the release of the 1HFY22 result in February. There are, however, no changes in the key assumptions we apply in the DCF which are an 8.6% WACC and 5.0% terminal growth rate. The net result is a 6% increase in our PT to $45.00 which has mostly been driven by increases in the relative valuations.

Investment view: Downgrade to HOLD

At our updated PT of $45.00 the total expected return is only 4% so we downgrade our recommendation from BUY to HOLD. The key risks to our downgrade are, firstly, the company does upgrade its FY22 guidance at the result in February but we believe this is already partly reflected in the share price. Secondly, an increased takeover offer from Autodesk and while we believe there is a reasonable chance of this occurring we do not believe there is a high probability. And thirdly a transformative and material acquisition but, as highlighted with Supplyframe, such opportunities are rare and difficult to close so again we do not attach a high probability to such a deal occurring.