A leading global Testing, Inspection & Certification Group

ALS (ALQ) is a global Testing, Inspection and Certification (TIC) company, servicing clients across several industries. ALQ commands a market-leading position in geochemical testing, leveraging its hub-and-spoke model, Laboratory Information Management System (LIMS) and innovative value-added capabilities. In Life Sciences, ALQ operates one of the largest global environmental testing businesses, with a footprint spanning 35+ countries. The company’s Pharmaceutical division aims to establish regional leadership in key geographies including Western Europe, delivering Contract Research Organisation (CRO) services, Beauty and Cosmetics claims testing and batch release testing. ALQ’s food testing division services clients across the food value chain from farm to food retailer, predominantly in Western Europe.

Tracking ahead of FY27 targets

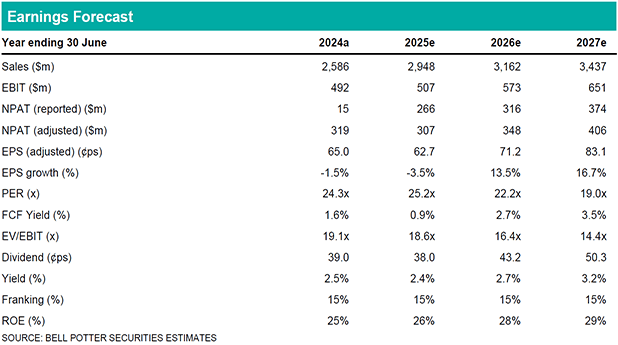

We forecast 8.5% EPS CAGR over FY24-27, with revenue and EBIT tracking ahead of the company’s FY27 targets ($3.3b and $0.6b, respectively). This outlook is underpinned by: (1) a recovery in exploration testing sample volume growth from FY26 and further take-up of higher margin, value-added services; (2) high single-digit organic revenue growth in Environmental driven by increased penetration and regulation in traditional markets and rapid growth in PFAS testing demand in the USA and key markets in Europe; (3) further business development success at Nuvisan and ongoing progression of the €25m (~A$43m) cost-out program (>50% complete), delivering significant profitability improvements by FY26; (4) greater demand for CRO services in Europe once the BIOSECURE Act is legislated in the USA; and (5) further scope growth in the Life Sciences segment through programmatic acquisitions.

Investment thesis: Initiate with Buy; TP$17.30/sh

We see compelling value in ALQ as an investment leveraged to increasing societal demands for green environmental testing practices, stringent enforcement of PFAS remediation and monitoring programs and a recovery in global exploration testing volumes and regional (European) CRO activity. ALQ should continue to create value through its targeted capital allocation framework, delivering >15% ROCE.