Abacus Storage King (ASK) is a top 3 owner-operator of self-storage facilities in Australia’s fragmented but rapidly consolidating self-storage market. It is externally managed by Abacus Group (ABG). We initiate coverage with a Buy recommendation.

Strong capital demand and valuation disconnect. Australia’s self-storage market is attracting increasing institutional capital. Prime storage assets are trading at-or-below c.5.0% cap rates (portfolios attracting a further c.50bp premium) yet ASK is trading at a listed market implied cap rate of 6.1% – +65bp wider than book, +85bp wider than BPe WACR (5.25%) and c.+50bp wider than the WACR implied by Brookfield / GIC’s bid for NSR. ASK received a takeover approach at a +3% premium to NTA in Apr-25, while sole listed peer NSR is currently subject to a +9% premium bid. ASK trades at a -13% discount to NTA (-20% to FY26e NTA), offering listed exposure to the sector at pricing inconsistent with private-market valuations.

Multiple levers for growth. ASK has 3 key earnings growth levers: 1) generating alpha across the operating portfolio, not just passive rent collection; 2) broad universe of accretive acquisition opportunities (some already under ASK mgmt.); and 3) deep development pipeline. These levers – particularly acquisitions and development (which account for >50% of incremental growth) – provide a higher degree of control over forward earnings and support a structurally higher multiple vs. more passive peers.

Upside catalysts not-in-the-price. While not in our valuation, the potential internalisation of management would likely lead to a near-immediate FFO uplift and the erosion of ASK’s ‘external manager discount’. Also, any further corporate activity in Australian self-storage (particularly if involving ASK) would likely be a positive catalyst.

Investment View: Initiate with Buy Rating

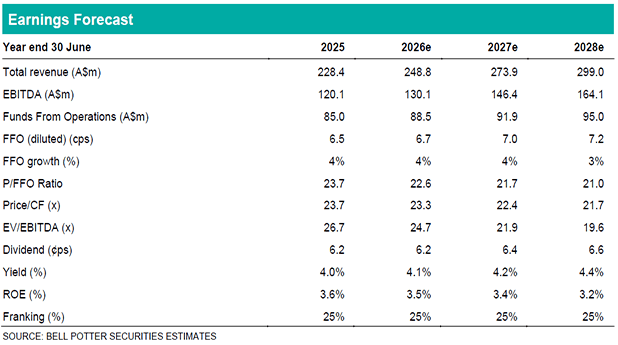

We initiate coverage of ASK with a Buy recommendation and a $1.70 target price. We forecast FY26e DPU of 6.2c (in line with guidance, VA consensus) and a 3yr EPS CAGR of +3.8%. While near term EPS growth is modest, the investment case is anchored in NTA compounding and convergence of listed market pricing toward private-market cap rates, with expected +8.2% 3yr NTA growth CAGR providing a clear benchmark for share price performance over time.