1HFY26 – Nothing to report

PDN recorded revenue of US$138m (+79% vs PcP, inline with our estimate of US$139m). COGS were US$91.3m, excluding depreciation, (BPe US$93.8m), largely inline with our expectations. Profit before tax was US$9.26m, BPe US$6.2m. Finance costs were US$15m, which were above our expectations, and drove the divergence in the bottom line result. Underlying loss after tax was -$6.6, with -$7.5m attributable to NCI and members of the parent recording a $0.872m profit, Vs BPe US$4.4m profit. EPS was US$0.2cps PDN finished the half with US$278.4m in cash and short term investments, following the A$300m equity raise, and $100m SPP.

Still looks cheap

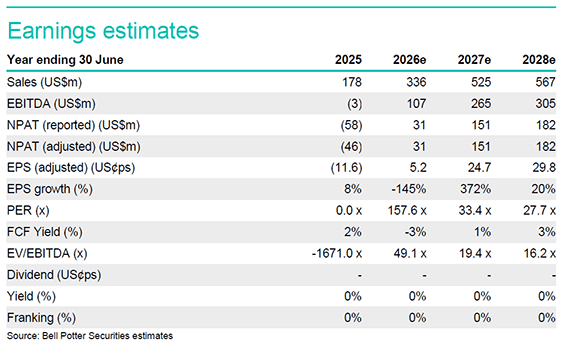

PDN recorded a markedly improved 2Q result, as the business completes the stockpile processing phase. The expectation, once operations rely more heavily on mined ore in the 2H, is for greater visibility on mill performance, grade and production. We suspect that should 3Q avoid any unforeseen disruptions, PDN will be cumupgrade. We forecast FY26 production of 4.75Mlbs, above the upper end of guidance of 4.5Mlbs. Our expectation is that, as PDN rebuilds its reputation as a stable, reliable producer, the market will be free to value the business in-line with North American peers. In particular, we believe the market is ascribing little value to the PLS asset. We recently held a presentation with Management which highlighted this point, and the potentially more streamlined permitting approach for PLS (provincial approval is required, not federal).

Investment thesis: Buy, TP $15.30 (unchanged)

We retain our Buy recommendation and $15.30/sh TP. PDN is positively exposed to rising uranium markets, with ~53% exposure to spot prices out to 2030. Production at LHM continues to improve, with transition to processing primally fresh ore, milled grades should lift from 501ppm over 1H, as should plant performance and reliability. The only risk we see is water disruptions as we enter a seasonally tricky period known for algal blooms which impact availability from the desalination plant.