Q2 highlights: FY26 contracted revenue already above FY25

Key points from ALC’s Q2 update were as follows: (1) FY26 contracted revenue is currently $43.1m (including both sold & renewals), an increase of +$6.8m from $36.3m at the prior quarter and already 6% above FY25 full-year revenue. (2) New TCV sales were $15.4m, of which $12.3m related to the Leidos expansion in November 2025. New TCV sales for the FY26 full year is tracking to ~$60m (including UHSx), meaning revenue backlog will increase for a second successive year. (3) Net operating cash outflow was -$1.9m (a $1.7m larger outflow compared the pcp), comprised of $8.5m in receipts (-6% on pcp) and $10.4m in payments (+12% on pcp). Cashflow is typically lumpy and ALC collected $8.8m in receipts within the first fortnight of January, hence we expect a material uplift in the $14.2m cash balance will come in 2H FY26.

Upgraded guidance and increased forecasts

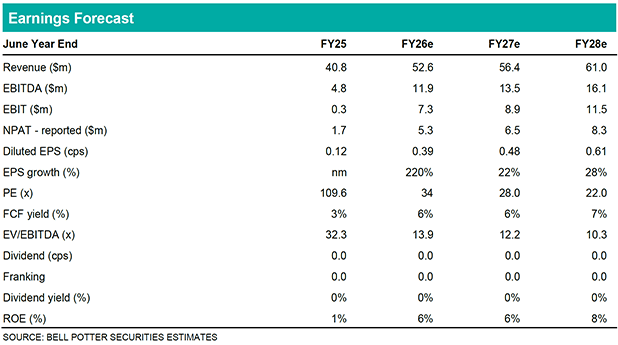

ALC increased guidance for FY26 EBITDA and operating cashflow from “positive” to “at least in line with FY25, with potential upside dependent on the successful completion of the UHSx contract and continued conversion of new revenue opportunities”, i.e. new guidance is EBITDA >$4.8m and operating cashflow >$5.8m, which appears very achievable. The Q2 update exceeded our prior expectations for FY26 contracted revenue. This, in combination with a closer analysis of our FY26 revenue build following recent contract announcements, has resulted in increases to FY26/27/28 revenue forecasts by ~$6m in each year (or 11%-13% increases).

Investment view: Maintain BUY; PT increased to $0.17

Valuation continues to comprise a 2:1 blend of DCF (10.0% WACC, 3.0% TGR) and EV/Rev (3.5x FY26). The increases to forecasts have led to an increase in PT from $0.15 to $0.17, hence we maintain our BUY recommendation. We are confident the material new contracts recently announced with UHSx and Leidos, alongside the existing sticky customer base, will deliver a strong 2H26 result for ALC that will see significant increases in revenue, earnings and cash balance for FY26 vs FY25.