Resumption of coverage

We resume coverage of GMD with a Buy recommendation and a $8.65/sh TP (previously Hold $4.45/sh). Our thesis is supported by 1) Growing production – GMD is a domestically focused gold miner with growing production from its Laverton & Leonora Hub and Spoke model, we model production CAGR at 15% out to 2030. 2) Leverage to A$ gold – GMD is largely unhedged, with ~11% of FY26 production covered by zero- cost collars, providing direct exposure to rising gold prices (spot US$4,515/oz, A$ 6,739/oz). 3) Strategy update in 2HFY26 – looks to target the bottleneck in growth, being mill capacity. We interpret this to be an expansion of Leonora, to ~3.8Mtpa (from 1.4Mtpa) with eventual Tower Hill material feeding this from FY28. 4) Management discipline – GMD’s management has developed a reputation for disciplined, counter cyclical M&A and has generated ~957% in shareholder return since listing. We anticipate this strategy to continue to perform as GMD builds out its Mineral portfolio, capitalizing on rising gold prices.

Valuation stretched, premium warranted for now

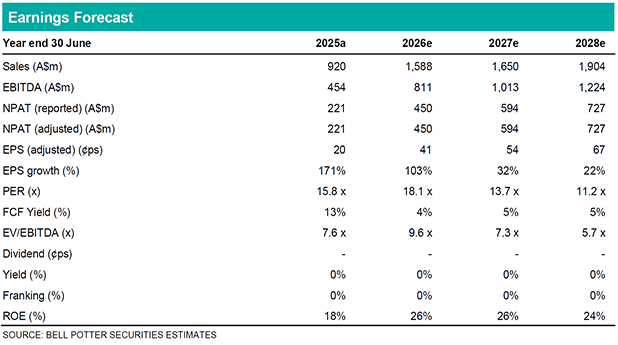

GMD’s trades on 7.8x EV/EBITDA (peer 5.5x) and 4.8x P/B, leading us to believe that the stock is pricing in a combination of future success, gold price appreciation and a quality premium. In a gold bull market this outlook is well supported. However, should commodity prices begin to turn we suspect GMD will be exposed given its above average valuation. Whilst the party continues however, GMD will continue to expand.

Investment thesis: Buy TP$8.65

We resume coverage of GMD with a $8.65 TP and a Buy recommendation (previously Hold $4.45/sh). We believe GMD to be a high-quality gold producer, expanding production underpinned by a large Mineral Resource portfolio (18.6Moz), into a rising gold price environment (Spot US$4,515/oz). Management’s disciplined approach to counter-cyclical growth has seen shareholders rewarded (12m rolling shareholder return – 194%).