ELS secures largest contract in its history

ELS has secured a US$21.2m contract, scheduled for delivery across January-April 2026. The contract is for the supply of Halo units and is with an existing European defence OEM customer. This order represents a 13.5-fold YoY increase in revenue over January-April 2025. The contract includes up-front payments to support working capital, with the remaining balance payable prior to delivery.

DIU Phase 3 selection to support further growth

In November 2025, the US Defense Innovation Unit selected ELS to progress its Halo platform to Phase 3 (fielding phase) of Project G.I., Design Reference Mission 2. This selection sends a strong signal to potential customers that Halo’s multi-link technology is highly capable of delivering reliable connectivity to mission-critical operations. A broadening of the customer base would be a key de-risking outcome for ELS.

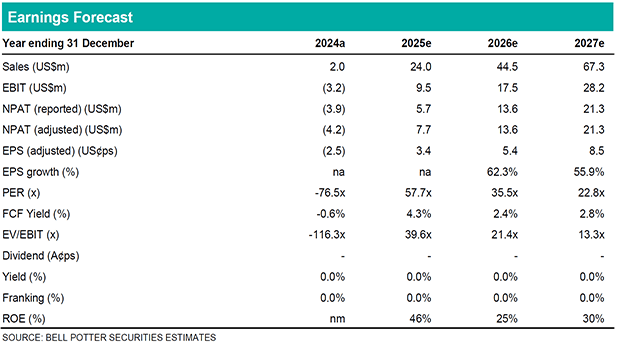

We have revised EPS -1/+21/+36% over CY25/26/27e reflecting higher revenue growth assumptions following today’s contract announcement and increased R&D and S&M opex. We estimate that our CY26e revenue forecast of US$44.5m is 61% backed by committed orders and recurring revenue from the CY25 ending install base. We have upgraded our target price to $3.60/sh reflecting: a lower WACC due to greater certainty in our forecasts given today’s announcement partially offset by increased risk to sentiment on a Ukraine peace deal; and higher terminal value NOPAT and ROIC.

Investment thesis: Buy; TP $3.60/sh (prev. $2.00/sh)

We retain our Buy rating. We believe ELS has developed a market leading product that is fully leveraged to the emerging use of unmanned systems in both a defence and commercial context. In CY26e, we expect ELS to be a beneficiary of downstream demand from global defence departments, supporting our 70% hardware sales revenue growth estimate. We believe ELS shares offer value at 21.4x CY26e EV/EBIT given its recurring revenue, capital-light business model, relative valuation vs. other drone exposed stocks and long runway of growth. We see upside to our revenue forecasts if ELS is able to broaden its customer base with large contract wins.