1Q26 update; trail of breadcrumbs on commencements

GMG provided a 1Q26 update reiterating FY26 operating EPS for +9% growth y/y (BPe +10%, VA consensus +10%). Key takeouts included:

(1) WIP down q/q but targeting >$17.5b by end FY26 – Development WIP declined -4% q/q to $12.4bn vs. $12.9bn FY25 and $12.8bn pcp, but GMG is targeting >$17.5b WIP across Data Centres (“DCs”) and Industrial by FY26. Powerbank remains 5.0GW (as per prior), and while the % of WIP related to DCs has increased to 68% (was 57%), development yields on cost have been maintained at 7.5% with $1.6bn of completions during the period comprising a majority in Asia. 10 sites across the DC book have been detailed, with some additions (PAR01, HK09) and removals / reductions (MEL01, TYO05) vs. prior but net net still c.0.5GW of utility power DC WIP.

(2) DC Partnerships / Leasing – Finite new information in terms of DC leasing and capital partner milestones since FY25 result, although multiple projects across North America, Europe, and Asia are on foot, and similarly Partnerships in Aus and Europe are “underway”.

(3) NPI growth softer but remains sound ex-China/HK – LFL NPI growth +4.2% vs. +5.1% FY25 and +4.9% pcp, but was +6.1% ex-China/HK.

Earnings changes

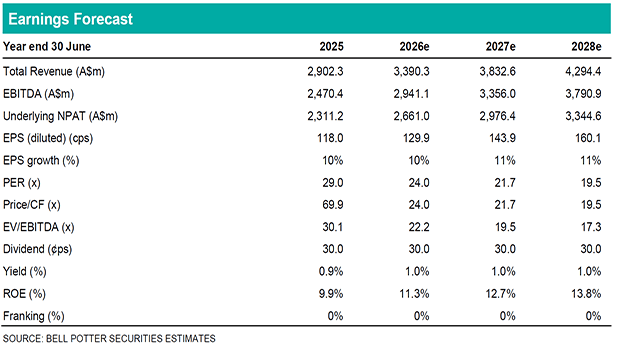

We adjust our FY26-28 EPS estimates by -1% to +1% reflecting: (1) divisionals estimates; (2) skew in earnings to 2H over 1H26; and (3) capex deployment timing. Our target price is based on 50 / 50 blend of our SOTP and DCF valuations.

Investment view: Buy

change to our Buy recommendation. The decline in WIP q/q was lower than we anticipated, however the direction of the book continues to grow (+35% y/y based on >$17.5b expectations), and we remain comfortable with the medium-term outlook, screening more attractively following recent underperformance (-14% vs. +2% XPJ y/y and +8% XJO y/y), trading at a +19% prem to ASX200 PE Rel vs. +53% 5yr avg.