A record September forecast

The ABARE Sep’25 east coast crop forecast is a record driven by material uplift in VIC and NSW production forecasts. Details below:

Winter East coast crop forecast: ABARE has issued a September 2025-26 east coast winter crop forecast of 30.0mt (vs. 28.8mt in the pcp, a R5YA of 25.5mt and Jun’25 forecast of 27.2mt). The forecast is predicated on an acreage forecast of 12.2mHa (vs. Jun’25 of 12.0mHa and final 2024-25 of 12.4mHa). Notable movements were in NSW up +13%, QLD up +9% and VIC up +7% from the Jun’25 forecast.

Summer crop forecast: The initial 2025-26 summer crop forecast has been set at 4.5mt and compares to the closing forecast of 5.2mt for the 2024-25 crop. Sorghum production is forecast at 2.4mt (vs. 2.7mt in 2024-25).

Other earnings drivers: Oilseed crush margin indicators look to be stronger in 1H26e than 2H25e. Grain basis remains unfavourable in Canada and Australia, though at levels not materially different from May’25 levels. Domestic grain prices have on average been 2-3% lower than those at 1H25 balance date (~$2-3m headwind based on 1H25 commodity risk movements).

On average the September forecast has been ~9% below the final. We would note that CSIRO Wheatcast projections and vegetation indexes in the east coast grain belt would imply a crop not materially different from a year ago.

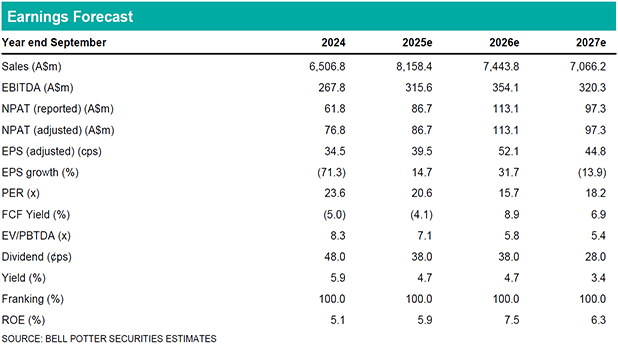

NPAT changes are -1% in FY25e, +16% in FY26e and +6% in FY27e. Our target price is lifted to $9.10ps (prev. $8.45ps) reflecting upward movements in peer group trading multiples.

Investment view: Buy rating unchanged

Our Buy rating is unchanged. Indicators for the 2025-26 winter crop remain positive and the prospects of a summer La Nina have been lifting. In addition, unlike this time a year ago canola crush margins have been strengthening rather than weakening.