Unhedged and debt-free production growth

CMM has announced that it has repaid the remaining $50m of its corporate debt facility and is now debt free. This had originally been established as a Project Finance Facility drawn to $90m in July 2021. CMM’s Board has assessed its funding needs and concluded current cash ($405m at 31 March 2025, for net debt $355m) and strong free cash flows will be sufficient to meet expansion plans. These comprise the development of the Mt Gibson Gold Project (MGGP) for total CAPEX of $346m (including $86m prestrip) and the expansion of the Karlawinda Gold Project (KGP) for CAPEX of $120m. Combined, these projects should lift CMM’s gold production to ~300kozpa.

Exceptionally strong position

We had previously modelled this facility to be rolled forward to supplement funding for development of the MGGP and expansion of the KGP. However, CMM’s balance sheet has benefitted from having previously closed out gold hedging commitments (158koz forward sold at ~A$2,300/oz) associated with the original Project Finance Facility. As a result, CMM has effectively been unhedged since June 2023. The higher free cash flows have boosted CMM’s balance sheet, including the addition of ~$40m in the March 2025 quarter (and after $16m CAPEX). We estimate remaining CAPEX across both projects of ~$430m (~$310m at MGGP, ~$120m at KGP) and, in our view, existing cash and free cash flow should be sufficient to fund the 12-month construction periods (to end FY26, pending receipt of permits). This is an exceptionally strong position to be in, ahead of delivering growth that will more than double production.

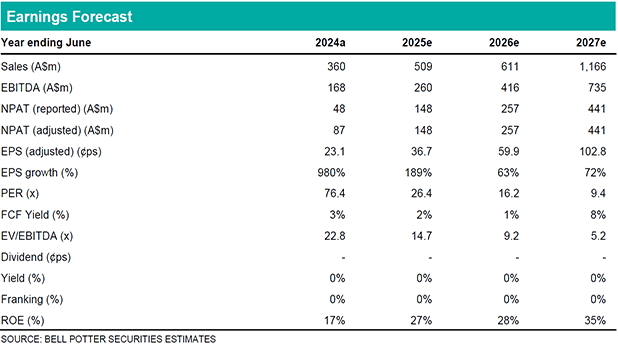

Investment thesis: Hold, TP$9.10/sh (from Hold, TP$9.03/sh)

EPS changes in this report are immaterial, limited to removal of a single year’s interest expense. CMM is a sector leading gold producer, fully funded to grow production from ~115kozpa to ~300kozpa at AISC of ~A$1,700/oz from FY27, from two gold mines in WA, each with +10 year mine lives and run by a management team that has an excellent track record of delivery. Our NPV-based valuation is up 1% to $9.10/sh. We retain our Hold recommendation.