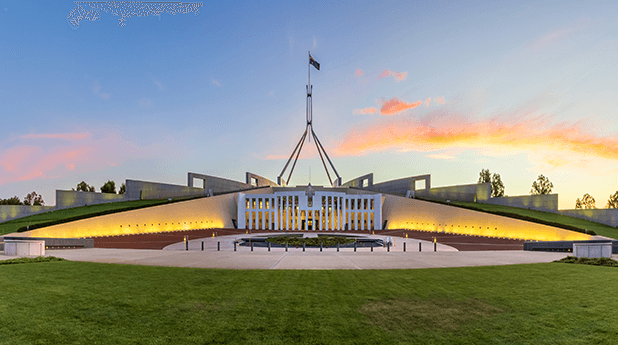

On the morning of 28 March, Prime Minister Anthony Albanese visited the Governor-General to officially commence the federal election, with the polling day set for Saturday, 3 May.

With Australians holding a total of $4.2 trillion in superannuation savings as of December 2024, superannuation remains a critical priority for the country. The confidence in our nation’s retirement savings scheme can be rapidly strengthened or eroded based on the policy decisions taken by the Government of the day.

Three years ago, Anthony Albanese assured Australia that Labor had no intention of making changes to superannuation. However, that position shifted in early 2023 with the announcement of the $3 million super tax, now formally known as Division 296.

To recap, Division 296 means individuals with a Total Superannuation Balance (TSB) exceeding $3 million as of 30 June each year will face an additional 15% tax. This tax will only apply to the earnings attributed to the balance exceeding $3 million, resulting in a total tax rate of 30% on the attributed earnings over $3 million. Notably, the $3 million threshold will not be indexed.

The Coalition has consistently opposed this tax increase, even pledging to repeal Division 296 if it passed before the election was called. The Bill was stalled in the Senate and has since lapsed, but it will likely still be on the cards if Labor comes in for a second term.

In contrast, the Coalition has proposed only one change to superannuation legislation – the policy that will allow first homebuyers to access up to $50,000, or 40%, from their superannuation to purchase a home, with the condition that the amount must be returned to superannuation if the house is later sold. Labor opposes this policy, preferring to address the housing crisis by building 1.2 million new homes under the National Housing Accord.

Although certain Coalition MPs have advocated for extensive changes to the superannuation system, such as reducing the superannuation guarantee from its present 11.5% to 9% p.a., these proposals have not received support from Opposition Leader Peter Dutton.

The prospect of a minority government could complicate the passage of even non-controversial measures, let alone contentious ones like the $3 million Division 296 tax. While superannuation is not playing a pivotal role in this election, like the cost-of-living, migration and an energy transition plan, if the safe custody of superannuation is a priority, voters can only base their decision on a party’s track record.

Learn more

If you have any questions, please get in touch with your Bell Potter adviser.

LEARN MORE

Our Technical Financial Advice team, in conjunction with a Bell Potter adviser can help you create a road map to achieve your financial goals, no matter where you are today. Whether you are looking for one-off advice or ongoing advice, our team can assist.

Get in touch with us to set up a complimentary initial appointment over the phone or in person across Australia.