3Q report: record production and $91m added to cash

Gold sales were 59.2koz, at All-in-Sustaining Costs (AISC) of A$2,323/oz and average gold price A$4,496/oz. The closing cash and liquids balance increased by $111m to $348m. The company reiterated that it remains on track to meet FY25 guidance 190koz-to-210koz at A$2,200/oz-to-A$2,400/oz. The 3Q performance was a significant beat on our forecasts. Gold production was 10koz greater than BPe, driven by third party ore purchases of 4.5koz, the Laverton low grade stockpile outperformed the Resource grade by 15%, and the Laverton plant operated at ~130ktpa above nameplate capacity.

Long-term outlook update with Resources / Reserves

GMD announced details of its work enhancing the long-term outlook, specifically its work growing production to 400koz. GMD released a Production Target (PT) of 65Mt at 2.1g/t Au for 4.5Moz. The PT is prepared in a similar manner to the Ore Reserve Estimate (ORE), but includes consideration of Inferred Mineral Resources. The PT contains 36% more gold than the previous ORE, at the same grade. The current 10- year outlook tops out at 325kozpa, pre-FY33. GMD is working on increasing production, (and bringing ounces forward) by studying expansion / optimisation of the LOM plan.

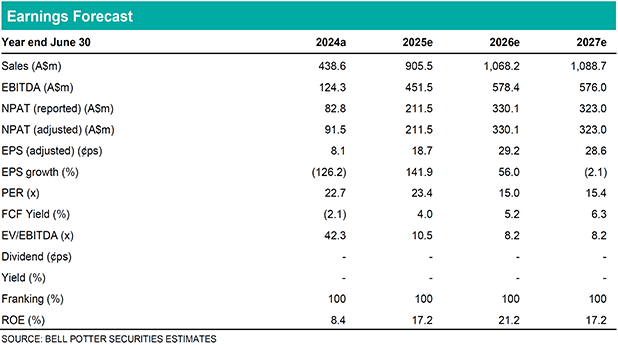

Investment view: Hold, TP$4.45ps (prev. $3.75ps)

With this update we increase our Target Price by 18.7%, after including our assessment of the incremental upside we estimate results from the Production Target ($740m, $0.65ps, risk discount 25%). In our view, expanding production to 400kozpa (23% over 325kozpa) is likely to be achievable from relatively modest processing plant expansions totalling 1Mtpa. We maintain our Hold recommendation on valuation grounds, as GMD’s share price has continued to appreciate strongly, applying our real long-term gold price forecast of A$3,800/oz (current spot A$5,150/oz). Our recommendation would upgrade to buy applying a real long-term gold price forecast of A$4,300/oz.