Recent contract awards add to momentum

In this report we outline recent company developments and key ideas in support of our Buy thesis. Key points:

Contract update: Since our last report published on 20 December 2024, GNP has announced two significant contract awards. Firstly, GNP was announced as the head contractor for TasNetworks’ Stage 1 North West Transmission Developments project. The initial phase of the contract (ECI Phase) is for the delivery of engineering and design works, valued at $42m. The second, Construction Phase is scheduled to commence in 2Q 2026, with completion expected in 2029. The total value of Stage 1 works is $950m. Secondly, GNP announced a work package for Western Power’s Clean Energy Link project (North Region) valued at ~$270m, with works to commence in January 2025 and scheduled to complete in mid-2027. In addition, GNP received a notice to proceed from Transgrid on the HumeLink Transmission Project. GNP anticipates commencing onsite works in May 2025 and practical completion in late 2027. GNP’s share of the HumeLink East project contract value is ~$350m.

Orderbook analysis: We have illustrated the revenue recognition profile of 8 major contracts announced over FY24-25 for completion in 2H FY25 onwards. Findings of our analysis highlight: (1) ~90%+ of our revenue forecasts are now contracted, giving us a high degree of confidence in our 23% EPS CAGR outlook; and (2) each successive major contract award from now will likely drive an upgrade to our (and possibly consensus) forecasts. You can find more details of our analysis on page 2 of this report.

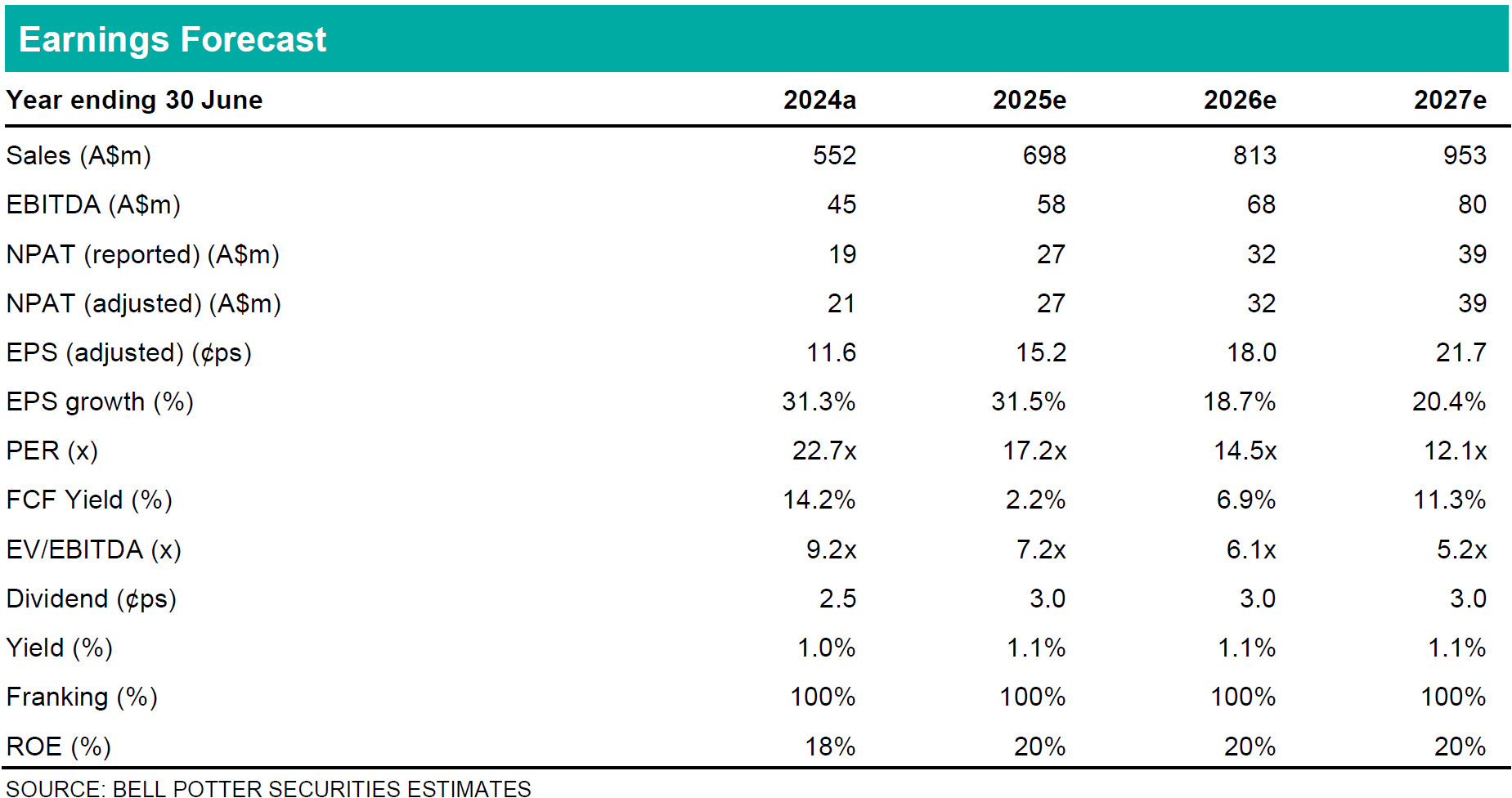

EPS changes: We make no material changes to our forecasts.

Investment thesis: Buy, TP$3.10/sh (unchanged)

We continue to see GNP as a key small-cap investment opportunity to play the theme of increasing investment in renewable energy, battery energy storage and transmission infrastructure across Australia. GNP’s valuation multiples are undemanding when considering our EPS CAGR expectation of 23% over FY24-27.