Contracts flowing from multiple sectors

SXE has provided two contract award updates within a week, with new contracts awarded across multiple sectors and by repeat clients totalling >$225m. We are pleased to see further contract awards in the Data Centre sector and an additional Healthcare work package to be delivered in the Illawarra region. Key points:

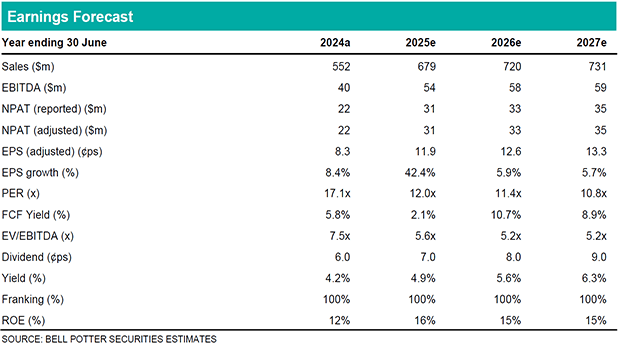

Orderbook bolstered: Excluding the ~$50m Collie BESS Project Switchyard construction package awarded on 5 July 2024, SXE has announced >$225m of new contract awards in FY25-to date, including purchase orders at Trivantage Manufacturing. These orders compare with >$140m of contracts awarded in the PcP and ~$470m in FY24 (including $210m of work packages for the Collie BESS project and switchyard). We expect SXE to deliver a 1H FY25 orderbook that is consistent with the record $720m reported at FY24, accounting for increased project delivery in 1H FY25, with revenue to lift 23% YoY to $314m.

FY25 EBITDA guidance: SXE continue to anticipate FY25 EBITDA of at least $53.0m (BPe $54.2m, implying >21% YoY growth). While FY25-to-date contract awards are encouraging for expected activity growth across the Group, we do anticipate a high level of work replenishment as contracts complete over FY25, maintaining an elevated EBITDA run-rate into FY26 (vs FY24: $40.1m). We see upside to our forecasts should FY25-to-date contract award momentum continue in 2H FY25.

EPS changes reflect a more optimistic medium-term view of Infrastructure project delivery: nc in FY25-26; and +7% in FY27.

Investment thesis: Buy; TP$2.25/sh (unchanged)

SXE brings key small cap exposure to several emerging and structural themes, including the proliferation of data centre construction across Australia, decarbonisation of the Australian economy, electrification of industries and the build-out of large-scale critical infrastructure. SXE’s blue-chip clientele and high proportion of recurring work (33% of FY24 Group revenue) provides some stability to operations and financials and reduced counterparty risk.