Company background

Woolworths (WOW) was established in 1924 in Sydney Australia and today through its 1,693 points of presence in Australia and NZ, is a leading supplier of food and everyday needs with complementary investments in Foodservice and Digital marketing. Since FY20 WOW has generated CAGR earnings growth of +7.9% p.a. while paying out 80% of cumulative profits in ordinary dividends lifting to 87% with inclusion of special (vs. a target of 70-75%). Looking forward we anticipate FY25e to be a year of consolidation, with headwinds in discretionary categories (Big W and B2B Australia) mitigated by a continued shift in Australian food consumption to in-home channels. Beyond FY25e, we would anticipate a resumption of growth as discretionary sectors recover and WOW cycles off commissioning costs related to investments in automated distribution and customer fulfilment facilities (ADC/CFC). We initiate coverage with a Hold rating and $31.75ps target price.

FY25e a year of consolidation, before a return to growth

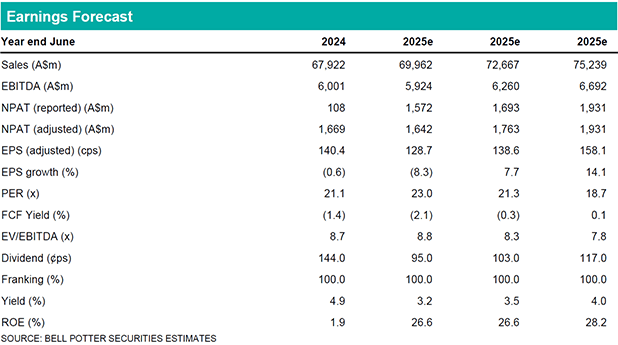

On a normalised basis (for a 52wk period in FY24) we forecast +4.1% p.a. compound growth in revenue resulting in compound NPAT growth of +5.2% p.a.. This view is predicated on: (1) Delivering targeted returns on a ~$1.5Bn capital investment program in ADC’s and CFC’s; (2) Growth in alternative revenue streams of digital marketing; (3) A recovery in consumer discretionary spending in FY26-27e benefiting Big W and Australia B2B; (4) Continued growth in core grocery retailing and Petcare segments; and (5) Mitigated in part by CDOB inflation and margin pressures FY25e. Articulation of a strategy to restore profitability in Big W is a potential alternative avenue for growth.

Investment view: Initiate coverage with a Hold rating

The recent share price correction in WOW following the commencement of legal action by the ACCC and softer 1H25 guidance in the Food business, sees WOW trade at a ~12% discount to its R2YA multiple. However, the greater relative exposure of WOW to discretionary categories that are likely to face sector headwinds in the near term and the modest trading premium to COL, sees us initiate with a Hold rating.