Introduction to Codan Limited

Codan is an Australian technology company that develops and manufactures innovative, mission critical communications and detection technology. CDA’s primary customers include defence, government departments, major corporates, small scale miners and individual consumers. CDA was founded in 1959 in Australia and listed on the ASX in 2003.

Successful M&A track record

CDA has a proven track record of successfully acquiring and integrating new business into group operations. Based on our forecast FCF growth, current net debt position and an increased debt facility ($200m), we believe the CDA balance sheet is in a healthy position with sufficient capacity to make further acquisitions. The company is not overly leveraged with a forecast Net debt to EBITDA ratio of 0.5 in FY25.

Diversified earnings, forecast margin expansion

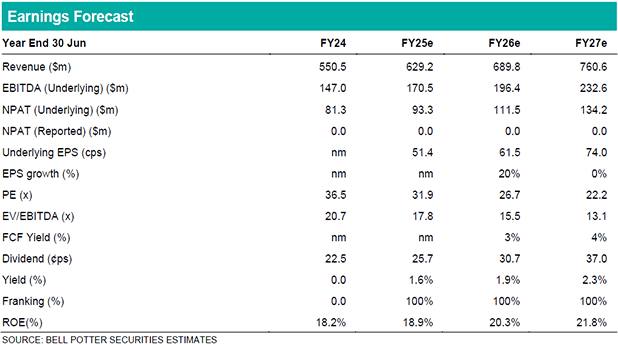

CDA has successfully diversified its earnings through a series of acquisitions, which has materially bolstered its communications offering and reduced its reliance on any one division or geography. Codan targets 10% – 15% organic revenue growth annually in the comms segment and is targeting a >30% segment EBIT margin through the realisation of additional operating leverage. We forecast comms segment EBIT margins of 25.8%, 27.1% and 30.0% in FY25, FY26 and FY27, respectively.

Investment View: Initiate with HOLD, PT $16.90

Codan’s strong operating performance over the last 18-months and attractive growth profile has rightly driven a significant re-rating in the stock. However, at ~22x EV/EBIT and ~32x PE, the stock is now trading at more than 2 standard deviations above its respective 3-yr historical medians, 12.7x and 15.0x. Whilst we believe the re-rating is justified, it is hard to argue the stock should be trading at a substantial premium to its current level, with the company looking close to fair value at present. As such, we initiate with a HOLD recommendation and a price target of $16.90.