Company background

Coles (COL) was established in Collingwood, VIC in 1914, though COL as we see it today was the result of a demerger from Wesfarmers in 2018. COL through its network of 856 grocery stores and 992 liquor outlets is a leading Australian retailer of fresh food, groceries, household goods and liquor, with a 50% interest in Flybuys rewards and a property development arm. Since FY20 COL has generated CAGR earnings growth of 3.7% p.a. while paying out 81% of cumulative profits in dividends, achieving 4.2% p.a. growth in dividends over that period. Looking forward, we anticipate delivery on business improvement initiatives (Simplify & Save) and delivery of targeted returns on recent capital initiatives to drive continued growth in earnings and dividends through to FY27e. We initiate coverage with a Buy rating and $21.55ps target price.

Multiple growth levers to FY27e

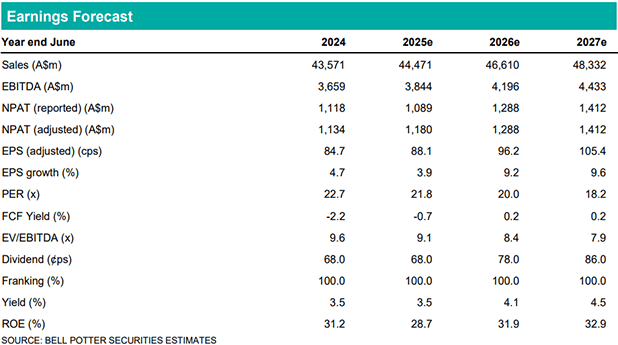

On a normalised basis (for a 52wk period in FY24 & CFC/ADC implementation costs) we forecast +9.1% p.a. compound growth in earnings to FY27e, with this flowing through to growth in dividends with the capex peak being past. This view is predicated on four core growth pillars being: (1) Business improvement through the Simplify & Save program targeting $1Bn in gains by FY27e (with $238m delivered in FY24); (2) Normalisation in loss rates. Loss increased 20% YOY in FY23 and while a continued headwind though FY24, was demonstrating a reversal in 2H24 (+44bp margin tailwind YOY in 2H24); (3) Delivering targeted returns on a ~$1.45Bn capital investment program in ADC’s and CFC’s reducing costs and releasing store capacity; and (4) Expansion of the store network at a pace consistent with population growth.

Investment view: Initiate coverage with a Buy rating

We initiate coverage with a Buy rating. While we see FY25e as a year of consolidation on a reported basis, we see COL as providing an attractive earnings growth profile through to FY27e on an underlying basis, with high levels of cash generation supporting growth in dividends. In addition, at 9.1x FY25e EBITDA, COL continues to reflect relative value compared to WOW (~5% discount).