Boost to submarine module production capacity

Austal has received a US$450m/ A$670m contract from General Dynamics Electric Boat (GDEB) to expand its shipyard in Mobile, Alabama by designing and constructing a new module fabrication and outfitting facility to support the U.S. Navy Submarine Industrial Base (SIB). This contract further strengthens ASB’s relationship with GDEB and is necessary to support the U.S. Navy goal of delivering one Columbia-class and two Virginia-class submarines annually. Construction of the new facility will begin this calendar year and be completed in 2026.

Key contributor to US naval industrial base

Nuclear-powered submarines are recognised as the ‘Crown Jewel’ of the US naval fleet and, as such, participation in the SIB is highly restricted. In recent years, ASB has played a small role in supporting GDEB in the construction of submarine modules, however, this contract demonstrates a material increase in its contribution to the SIB. In our view, this contract is a major development because 1) submarine module fabrication provides a long-term pipeline of sustainable work, 2) funding from GDEB for the major expansion alleviates any potential BS concern, and 3) it reiterates ASB’s standing as a responsible contractor to the US Navy and likely removes any risk to this position changing following the conclusion of DOJ investigations.

Investment View: 15% increase in PT to $3.15

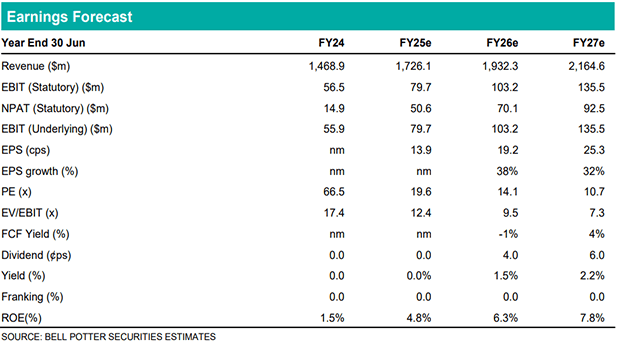

We have not factored this contract into our estimates at this stage as we await further updates regarding the recognition of the associated income and costs. However, we believe this is a significant development for ASB that will diversify its shipbuilding operations, drive long-term revenue growth and reinforce its position as a key contributor to the US naval industrial base. As such, we have reduced the WACC in our DCF valuation from 11.0% to 10.5% and increased the multiples in our EV/EBIT and PE valuations to 15.0x and 20.0x, respectively. The net result is a 15% increase in our price target to $3.15, which remains a >15% premium to the current share price so we retain our BUY recommendation.