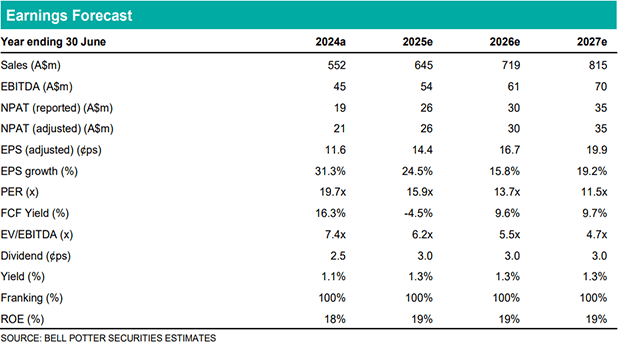

Project pipeline to support 20% p.a. EPS CAGR (FY24-27)

In this report, we have revisited our forecasts, with considerations made on the outlook for the HumeLink East project and the Infrastructure segment. We note the following:

HumeLink East Project considerations: We apply more conservative revenue forecasts in FY26, shifting 28% of our prior estimate into FY27, and assuming peak labour deployment extends another 6 months into FY27. We also anticipate an allocation of labour resources from the Infrastructure segment (ex-HumeLink East contract) to the HumeLink East project in 2H FY25 to 2H FY26 to satisfy ramping activity at site. We expect this allocation of labour to result in a 22% contraction in Infrastructure segment revenue (ex-HumeLink East contract) in FY26. EBITDA margins should rise before peak labour deployment is achieved in FY26; we estimate GNP can deliver an EBITDA margin of 8.4% over the life of the contract.

Robust short-to-medium term outlook: Recent contract wins for the delivery of maintenance and upgrade works at transmission and distribution networks across Australia should support further recurring deliverables in addition to long-term / panel workflow. Revenue from recurring works has grown at a CAGR of 50% p.a. between FY20-24. Solar and wind project delivery, with increasing BESS integration, represents a significant opportunity for GNP in addition to several greenfield large-scale transmission developments scheduled to be built over the next 3-5 years.

EPS changes: Reflecting our considerations above, we have shifted $65m of revenue from the HumeLink East project in FY26 into FY27, and assumed a 22% contraction in Infrastructure segment revenue (ex-HumeLink East contract) in FY26: FY25 nc; FY26 -19%; and FY27 +16%.

Investment thesis: Buy, TP$2.70/sh (unchanged)

We continue to see GNP as a key small-cap investment opportunity to play the theme of increasing investment in renewable energy, battery energy storage and transmission infrastructure across Australia. We see GNP’s valuation multiples as undemanding considering our EPS CAGR expectation of 20% p.a. over FY24-27.