FY24 earnings have faced headwinds from a combination of factors: higher interest rates dampening consumer spending, intensified competition eroding bank margins, rising labour costs, and lower commodity prices compared to FY23.

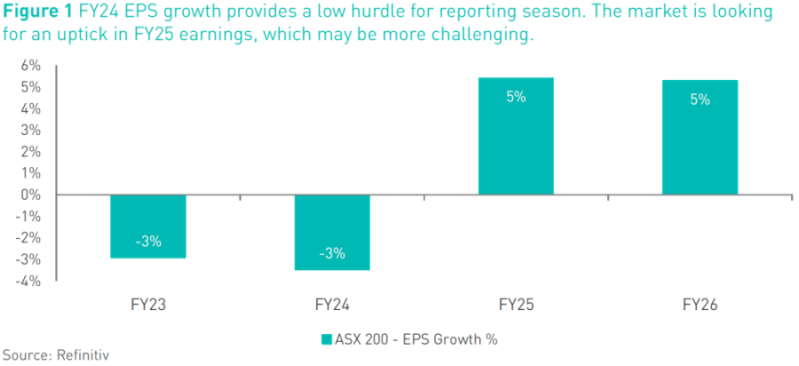

However, the ASX 200 has a low hurdle to jump for FY24. The August reporting season is anticipated to confirm a subdued earnings environment, with index-weighted consensus earnings projected to decrease by 3.5% year-over-year. The median earnings growth expected for ASX 200 companies in FY24 is 1%, also indicating a muted picture for FY24. FY24 earnings should be a hurdle the market can jump.

FY25 hurdle higher

FY25 is a more challenging hurdle. The market expects ASX 200 earnings to return to growth in FY25 (+5.4%). The median earnings growth expected for ASX 200 companies in FY25 is 12%. Shifting from a market-weighted to a median approach reveals a notably different and more substantial uplift in the ASX 200’s earnings outlook, indicating robust growth expectations among mid/small caps in FY25.

Historically, the market is too optimistic about the year ahead, with the market typically downgrading rather than upgrading. FY25 trading updates and outlook statements will be key. Analysts may downgrade their FY25 earnings forecasts should the upcoming reporting season expose the extent to which elevated interest rates and economic slowdown are impacting corporate earnings.

Weak earnings may refocus market attention to the near term

Despite flat earnings estimates (on aggregate) over the last 6 months, the market has continued its rally that started in November last year. Therefore, the market’s P/E has continued to re-rate into these results. An elevated P/E indicates elevated market

expectations. We expect the market to remain sensitive to misses as expectations remain elevated.

In our view, the market is looking to FY26 and beyond. With RBA rate cuts expected in early FY26, the current market PE suggests the market is looking for earnings upgrades in the next 12-18 months (not FY24). However, FY24 earnings and FY25 outlook statements must remain reasonably well-behaved; a disappointing earnings season may refocus the market’s attention and stall the market rally or lead to a correction.

Key Takeaways

- FY24 earnings: A low bar to clear Earnings are projected to decline slightly, setting a low hurdle for the market to surpass.

- Divergence for FY24 earnings: The FY24 earnings season is expected to see mixed results across sectors, with growth primarily concentrated in travel, insurance, healthcare, and pockets of quality.

- FY25 earnings – A tougher test: FY25 could be a more challenging hurdle, with ~6% expected earnings growth for the ASX 200.

- FY25 growth broad-based: Most sectors are expected to grow earnings in FY25. A macro backdrop of elevated interest rates and a slowing economy are unlikely to coincide with broad-based sector earnings growth. These results may be a catalyst for FY25 downgrades.

- Upgrade risks?: Earnings upgrades may occur for companies demonstrating effective cost-cutting, resilience in consumer sectors, or benefiting from waning input cost pressures.

- Downgrade risks?: Earnings downgrades may affect companies experiencing cyclical weakness, struggling with higher interest costs, or still facing persistently high operating costs.