FY24 preview

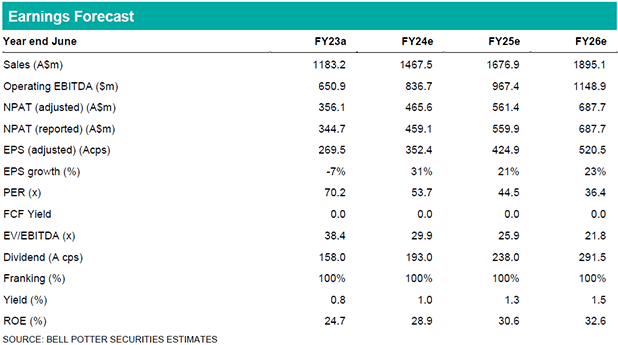

Following recent industry data releases we have reviewed our FY24/25 forecasts and anticipate a strong FY24 performance at the result on 8th August, driven by potential listings growth above REA commentary for a 5-7% range (BPe: 8%) and positive geo mix (BPe: 2.5%) from outperformance in key Syd/Mel markets. We expect 2% increase in revenue to $1,468m (Bberg consensus: $1,443m), and a 4% increase in EBITDA to $809m (consensus: $813m) incorporating 18.5% opex growth and the midpoint of guidance for share of associate losses. Our revised estimates for FY24 EPS (BPe: 352cps) and DPS (BPe: 193cps) are in-line with consensus following upgrades of 8%/4%.

Increasing free cash flows generate positive feedback loop

We continue to observe positive operating condition, underpinned by ongoing increases in total loan originations which grew 25%/16% on R6m/R12m bases in June. Increase in lending appears to be supported by pull forward of recent tax cuts, which has the potential to meet rate cuts in 2HFY25. FY25 cycles a tougher comp in both listings and geo mix following outperformance in Syd/Mel, however we see further growth in FY25 from a mix of avg. price increase and product uptake underpinned by $111m in FY24 BPe software capex. We make immaterial changes to FY25e/26e EPS with forecast growth of 21%/23%.

Investment view: Upgrade to Buy, TP $218.00/sh

We upgrade to a Buy recommendation following the recent pullback, model roll forward to proportionally account for FY26, and adjustment in our prev. equal weighted valuation to 40% EV/EBITDA, 40% SOTP and 20% DCF. We prefer REA due to its large audience and network effect, generating pricing power and an economic moat that is difficult to duplicate. REA’s continues to entrench its market leader position through a virtuous free cash flow/platform re-investment cycle which is returning 30%+ on invested capital. We see some relative value emerging end-FY25 with REA trading on forward looking discounts to current TTM multiples.