Reading between the lines

BOE finished the quarter having produced 57,364lbs of U3O8 through to the drying and packaging circuit, with 28,844lbs drummed from its Honeymoon uranium project. The material was produced via the 16 operating wells and single ion exchange (IX) column. Total flow through the IX column was 327,000 m3 over the quarter, with average uranium tenor of 80mg/l and a recovery of 99.65%. Comparing to the figures in the enhanced feasibility study, which estimated a flow rate of 1,560m3/hr for the 3 IX columns (520m3/hr per column = ~1M m3 per Qtr at 90% availability) and a 47mg/l tenor from the PLS provides the indication that operationally, Honeymoon is doing better than anticipated. The question is, what has the market factored in and where are we in reference to that?

Go with the flow

We’ve run two scenarios, assuming flow rates remain constant, with the exception of lower tenors of 47mg/l in the pregnant leach solution (PLS) and lower recovery (95%). The difference in each scenario is timing of commissioning, defined as filling the IX columns with PLS. Under the first scenario, we assume commissioning at the beginning of the quarter, similar to IX 1 which was commissioned in early Apr-24, and the second scenario we assume a mid-quarter commissioning. The greatest variability outside commencement of commissioning will be the PLS tenor and recovery. Should the current conditions hold, BOE is in a comfortable position to beat guidance and consensus for FY25 production, in our opinion. Visible Alpha production consensus is 850Mlbs for FY25, scaling from 103klbs in Sep-Q to 321klbs in Jun-25.

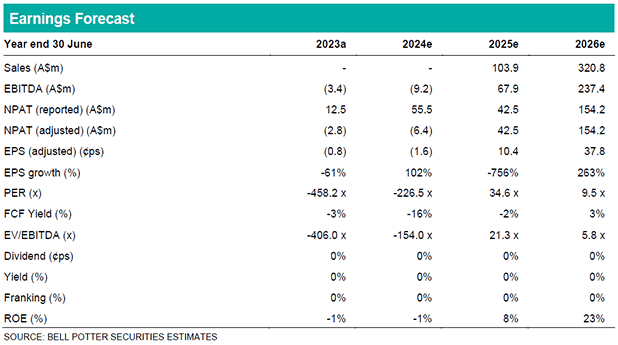

Investment Thesis – Buy, Target Price $5.75/sh

Our target price decreases to $5.75/sh (previously $5.90/sh), on incorporation of the quarterly result. We continue to see value in BOE at these levels, with the market remaining cautious on production and uranium prices over FY25. BOE needs to rebuild the momentum and faith in the market, which in our opinion will occur over the next six months as they prove the ramp up of Honeymoon and Alta Mesa.