Revenues in Line, Gross Margin Beat

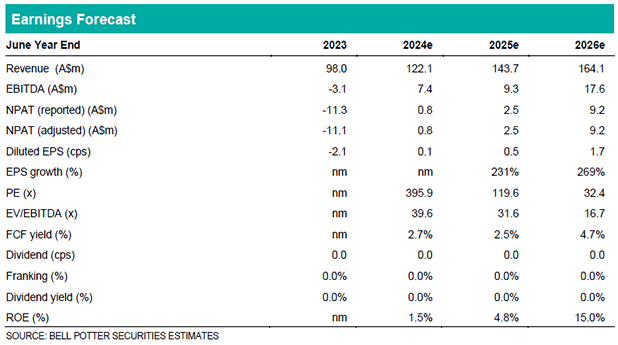

MDR had another strong quarter of topline growth in the US and ANZ, while gross margins also improved. Q4 revenue was $22.3m (up +32% on pcp). Full-year revenue was $122.1m (+25% on pcp) and in line with pre-released guidance of $120m-123m and BPe $122.0m. The highlight of the Q4 update was a strong recovery in 2H24 gross margins. FY24 gross margin was ~60.8% (vs. 60.6% in FY23), with the driver being 2H24 gross margin of 66.1% vs. 57.5% in 1H24. Cash balance was $15.6m as at 30th June 2024, down from $19.5m at 31st March. FY24 free cashflow was $5.3m (up from -$1.6m in FY23).

THRiV Uptake Continues

US customers are steadily adopting MDR’s newer THRiV offering, an omni-channel platform that results in higher gross margins and ROI compared to traditional campaigns. THRiV made up ~48% of Q4 US revenue compared to ~3% in the pcp, with gross margins benefiting as a result. In the ANZ market, transaction fees for vaccination programs were implemented in March and helped increase revenue +27% on pcp to $7.0m. Additional health programs with ANZ pharma companies also contributed to topline growth. Overall, Q4 was another solid quarter of topline growth in line with expectations. The limited outlook commentary included: “advances across the business in FY24 have provided a strong foundation for continued growth into FY25… driven by the increasing adoption of our omni-channel patient engagement solutions.”

Investment view: Maintain BUY; PT $0.64 (was $0.49)

We have made minor changes to earnings and rolled forward the DCF and EV/Revenue valuation methods. EV/Revenue multiple is increased to 2.5x FY25e revenue (previously 2.0x FY24). DCF assumptions are 9.6% WACC and 2.0% TGR. Our PT is increased to $0.64, which is >15% the current share price, hence we maintain our BUY recommendation. The next anticipated catalyst is the full-year result in late August.