New merchant verticals look to deliver value

Smartpay’s AGM included a trading update that highlighted merchant conditions over April and May. Milestone progress on the New Zealand proposition was also provided.

Merchant terminals: The Australian terminals fleet grew to 19,100 units and the all important net adds were +700 over April-May. The Australian merchant base rose to 13,500 (13,000 FY24) and we estimate similar onboarding rates have been sustained, with an average 1.4x terminals per new customer in April and May. While the company no longer provides quarterly updates, our forecast net adds in 1Q25 is +700.

Acquiring revenues: We estimate monthly recurring revenue of NZ$384 per average unit deployed in May. Management guided to soft total transaction value for hospitality merchants (down ~10% in the worst effected vertical), so aggregate growth of 0.7% versus 1H24 (~NZ$381) looks positive. We believe that recent customer acquisitions are starting to bear fruit, driven by back-book churn (including attrition from the legacy integrations) and newly onboarded merchants that exhibit better value and margin.

We estimate a 1.31% revenue margin for May 2024 (1.27% 1H24). In our opinion this reinforces the end-to-end payments proposition; and suggests a continued take-up for the company’s Zero Cost™ EFTPOS surcharge solution.

Network effect: End-to-end testing for the New Zealand android terminal is on-track and scheduled to commence with partners in July.

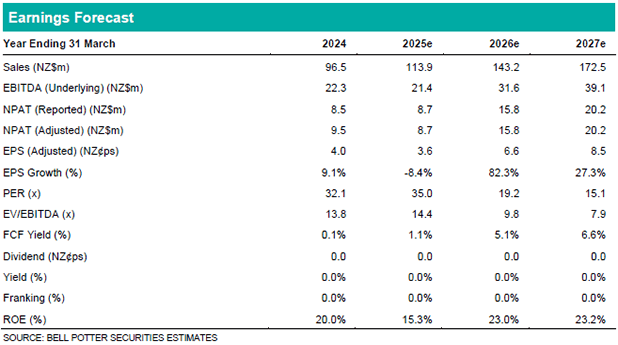

1Q is usually soft for net adds and we make no change to our revenue forecasts.

Investment view: Maintain Hold; PT $1.30 p/s

SMP has an implied 7.6% market share for small business EFTPOS terminals. While we see headroom to further grow market share, our investment thesis is predicated on scalability. Insufficient cash conversion could limit unit deployments and double-digit revenue growth on our estimates. We note that unit hardware capex and marketing costs increased in 2H24. Likely catalysts will be: (1) further ARPU improvement; and (2) operating leverage from expensed CACs when the NZ proposition is launched.