Company description and investment view

HUB24 (HUB) is a specialist investment platform provider with over $100bn in Funds Under Administration (FUA), housed through wrap and superannuation-based portfolio solutions. Around $80bn of the FUA relates to custodial services that provide financial intermediaries with a consolidated way to acquire, hold and administer a broad range of investments. We initiate on HUB with a Buy recommendation and a Target Price of $53.20 p/s. Our favourable investment view is supported by: (1) changes in advice, with investment professionals shifting away from institutionally owned platforms while seeking comprehensive technology solutions; (2) single digit market share and leading capital flows; and (3) increases to the super guarantee contribution and rollovers into self-managed super funds.

Coming to the point of difference…

We believe that average revenue margins will compress slower than peers, predicated on the utility ecosystem for its products and strong intermediated customer base. HUB recently acquired Class, an administrative SaaS solution to Australia’s superannuation sector and myprosperity, a leading provider of front-end client portals with digital tools to increase practice efficiencies. We prefer the more diversified revenue mix and see integrated services as a winning formula.

Investment view: Initiate with a Buy; TP $53.20 p/s

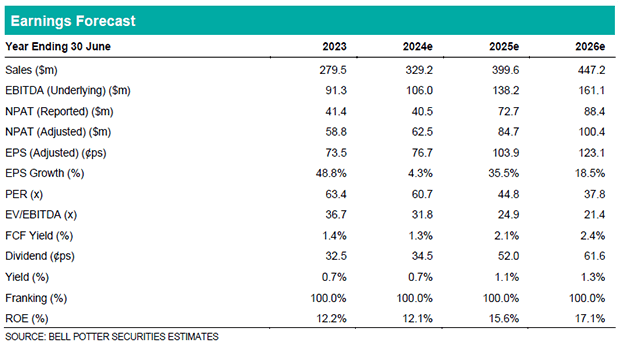

Traditional Dealer Group attrition and a decade of underinvestment in technology has been a tailwind for specialist platform providers. Incumbents with legacy systems have ~$600bn in total FUA that could be redistributed in the medium-term. Adviser ratings recognised HUB as the best functional platform for the second consecutive year and we see this as an opportunity to upsell on capital flows. Netwealth (NWL; Not Rated) is trading on a blended 1 year forward EV/EBITDA of 32.9x with lower forecast FUA and mature EBIT margins. We don’t believe HUB’s trading discount of ~26% is justified and see the potential for it to rerate, predicated on superior technology, recurring revenue growth and operating leverage.