Reviewing vitiligo expectations, Phase 3 readout CY25

CUV are conducting two Phase 3 trials to expand the label of Scenesse to include patients with vitiligo. Following recent company announcements, we have revisited vitiligo development expectations and market forecasts. The first Phase 3 trial primary readout is expected in 2H CY25 and represents one of the next major catalysts for the company excluding financial results. Assuming the Phase 3 trials proceed smoothly, we expect submission to the FDA in late CY26 for potential approval by end-CY27.

With ~1% of the US population affected by vitiligo, the market size is far greater than the single rare disease for which Scenesse is currently approved. We estimate a directly addressable vitiligo market in the US of ~65-70k patients (vs. ~2k patients for EPP). This translates into legitimate potential for Scenesse to increase its annual sales several fold if the Phase 3 trials succeed and regulatory approval is granted.

Generic drug for ACTH also progressing

Beyond vitiligo, CUV are pursuing Scenesse label expansion in other rare diseases (e.g. xeroderma pigmentosum and variegate porphyria) with smaller market opportunities. We also have a positive view on CUV’s development of an ACTH generic, a peptide closely related to Scenesse and expected to be submitted to the FDA in CY26. Only two ACTH products are on the market currently with combined annual sales of ~US$600m.

Investment view: Maintain BUY and $22.25 PT

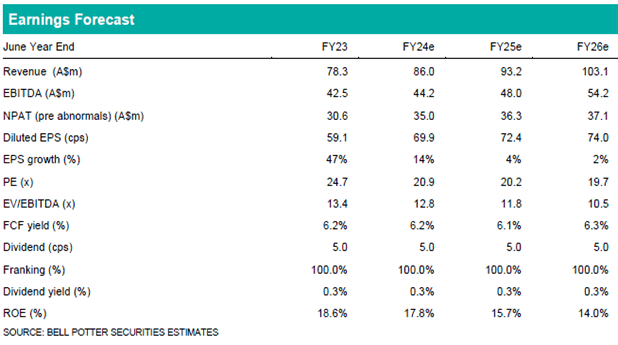

Our near-term forecasts remain unchanged and are based on ongoing sales in EPP, where CUV is expected to maintain a commercial monopoly for at least another 3-4 years. There is no change to our BUY recommendation and $22.25 PT. Our valuation is based on a DCF (10.0% WACC, 2.0% TGR) and EV/EBITDA multiple (17.5x). We view the first vitiligo Phase 3 readout in CY25 as a significant catalyst for the company and see the current CUV price as a good entry point for those willing to take on clinical risk with downside mitigated to a degree by the existing, profitable EPP franchise.