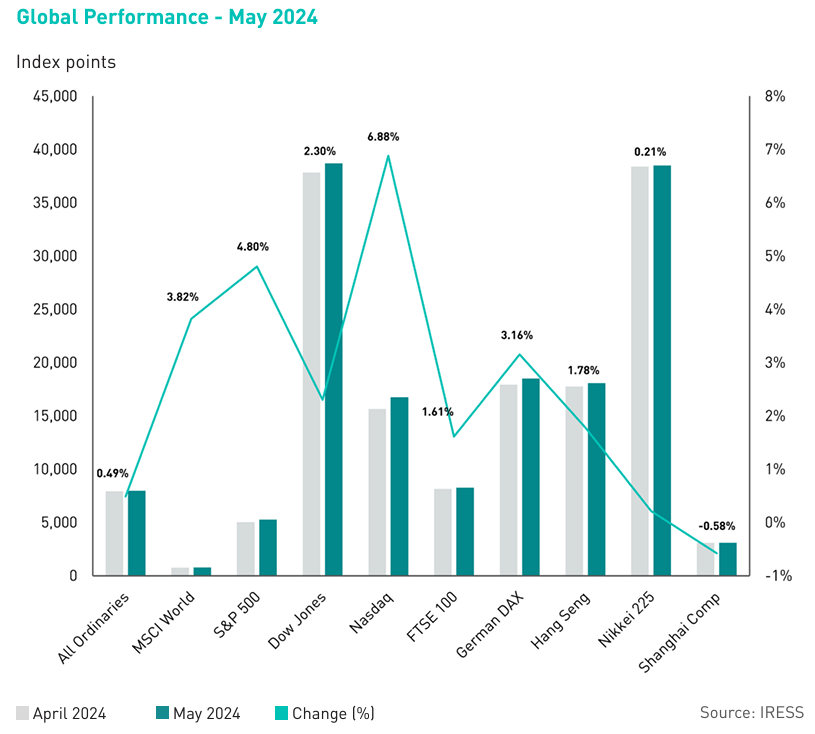

Following a very strong recent run, most share markets took a breather in the final week of May but overall posted healthy gains for the month. The S&P 500 added 4.8%, Nasdaq was up 6.9%, and MSCI ACWI Index finished the month 3.8% higher. However, the U.K.’s FTSE lagged, up 1.6% as surprise general elections weighed on investor sentiment while China’s Shanghai Composite underperformed, slipping 0.6%.

On the economic data front, after surprisingly strong Q1 inflation, core PCE inflation in the U.S. slowed at 0.249% month-on-month and 2.75% year-on-year which was close to consensus and U.S. Fed official expectations. Furthermore, U.S. GDP was also revised lower from 1.6% in Q1 previously to 1.3% on softer durable goods spending and in this regard, the 0.1% month-on-month decline in real consumer spending was further evidence of a moderate slowdown in real activity.

In our view, downward revisions to U.S. economic growth and lower inflation should be an encouraging sign for U.S. Fed officials that inflation is continuing to ease and a number of rate cuts are warranted later this year. While markets are pricing in the first rate cut in September, we estimate a July cut to be a possibility as activity slows and labour markets loosen.

In the Eurozone, headline inflation increased from 2.4% year-on-year in April to 2.6% year-on-year in May. In spite of this recent uptick in inflation, the ECB is expected to announce its first 25 basis points interest rate cut in eight years on Thursday 6th June as the inflation profile overall continues to trend down (albeit still elevated) and economic growth remains subdued.

In China, both manufacturing and non-manufacturing PMIs surprised to the downside in May. The May manufacturing PMI slipped again into contraction territory, losing a sizable 0.9% points to 49.5, much lower than market expectations as persistent demand weakness eroded production strength. Non-manufacturing PMI was basically flat from last month at 51.1, below market consensus at 51.5.

In commodities, iron ore prices remained around US$115/tonne, and gold trended sideways at US$2,348/ounce. Oil prices continued to ease lower within the US$82-85 range seen through May, with prices hovering at US$81/barrel on the back of weaker data, including rising oil inventories, tepid demand, and refinery margin weakness and the increasing risk of run cuts.

Given this backdrop, we continue to expect that OPEC+ holds its production cuts and more recently, OPEC+ has agreed to extend most of its deep oil output cuts well into 2025.

In regards to copper, the commodity finished the month at US$9,913/ tonne and we expect consolidation in copper prices over the next 3-6 months although, more broadly, the red metal is on a path to US$12,000k/t over the next 12-18 months, with the timing and degree of the next leg in the bull market depending on degree of easing in both China and the U.S. along with global manufacturing recovery.

In Conclusion

As we move closer to the halfway mark for calendar 2024, the U.S. economy has displayed remarkable resilience, with stocks at near all-time highs and the S&P 500 defying forecasts for a slowdown. Looking ahead, the overall global outlook hinges on U.S. performance and the U.S. trajectory will affect global outcomes directly, due to the large U.S. share in global activity, but also indirectly through– for example the implications for other central banks.

While the debate on interest rate direction persists for most economies, the cycle finally appears to be turning in the U.S . The U.S. Federal Reserve’s next interest-rate meeting is set for June 11 & 12 and a majority of economists expect that there will be no change at this meeting based on guidance from Fed officials over the past six weeks. While markets are now pricing in a cut in September, economists expect a July cut to remain a very likely possibility as despite all the concern with recent inflation readings, disinflation seems to have made sufficient progress along with signs of softening in the economy and weaker labour markets.

Against the backdrop of geopolitical challenges, the complex economic and investment landscape continues to evolve and therefore, the path being travelled is both unprecedented and unpredictable. However, a well-diversified and balanced portfolio across assets and regions along with exposure to structural themes is likely to benefit investors who remain nimble and are prepared for surprises.