CMI acquisition and successful $65m equity raising

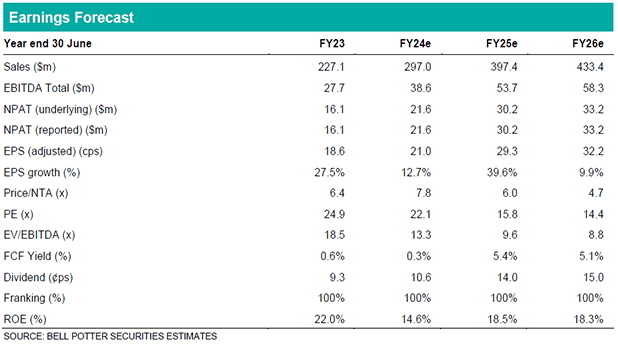

IPD has announced the acquisition of CMI Operations – one of Australia’s leading electrical cables and industrial plugs suppliers – for an upfront $92.1m and contingent consideration of up to $8.9m. To fund the acquisition IPD undertook a fully underwritten $65m equity raising (at a 5% discount to TERP) and received strong support for the institutional component of the raising finalised on 30 Nov’24. IPD has also secured new debt financing arrangements totalling $40m. We have the CMI deal at ~24% accretive to FY25e and IPD’s gearing at a comfortable ~0.8x EBITDA at FY24e (incl. earn-outs). CMI is owned by ASX LIC Excelsior (ECL) and the group’s directors (~50.4% of issued capital) have confirmed their intent to vote in favour of the transaction which, subject to approval, is expected to complete by Feb’24.

As part of the announcement IPD provided a strong trading update with 1H24e underlying EBITDA expected to be the region of $16.0-16.5m (vs. BPe prev. $15.9m). Management also expects “a number of significant projects” to commence in 2H24e.

Investment view: Maintain Buy recommendation

Overall, we view CMI as a strong addition to IPD’s existing product suite (e.g. high internal IP, same customers, improves IPD’s supplier diversity). In addition, the transaction price (trailing EV/EBITDA of 5.9x excl. synergies) would also appear to be reasonable for what we see as an established category leader in hazardous area and electrical safety verticals (e.g. mining and infrastructure). Further rationale for the deal as cited by IPD included: (1) synergy expectations from cross-selling and internalising cables revenue slippage (unquantified at this stage); (2) CMI’s recurring revenue profile and strong cash generation (e.g. plugs sales are driven by a regulatory replacement cycle); and (3) CMI’s attractive growth potential in new markets following the recent launch of the CMI’s ‘Minto 2’ product.

Following the CMI acquisition our EPS changes are -3%, +23% and +22% across FY24-26e. At this stage we assume four months of CMI contribution in FY24e. Our revised PT is $5.75 (prev. $5.50) with our Buy recommendation remaining unchanged.