Boutique alternative manager

Regal Partners (RPL) is a relatively small, but rapidly growing boutique asset manager offering a range of alternative strategies across $5.5bn of FUM (at 31 March 2023). It is generating positive net inflows, which is unusual in the asset management industry (outside of Private market and ESG type strategies). It has a highly entrepreneurial culture, as illustrated by the expansion through M&A (Attunga, Kilter, VGI Partners, East Point), the launch of new strategies (7 in the last three years), and the ambitious approach to Perpetual (PPT BUY PT $30.50) in late 2022. RPL is well diversified, with around 27 funds offering active, high conviction exposure to a wide range of assets and strategies including long/short, emerging companies, small companies, resource royalties, water assets, carbon assets, and private markets. It is highly profitable with high management fees averaging 115bps, with considerable performance fees, which have in the past exceeded the management fees. But a flip side to the entrepreneurial cultural is the limited free float. Around 80% of the stock is held by insiders (past or present) meaning there is little liquidity in the shares. We expect the free float to increase as the business acquires and continues to add teams. About $0.8bn or 20% of FUM at 31 Dec 2022 is not fee earning (largely held by staff, although rebates will reduce in 2024). There is considerable key man risk to the business (Mainly through Phil King and Rob Luciano, as well as other key managers).

Investment view: BUY target price $3.71/sh

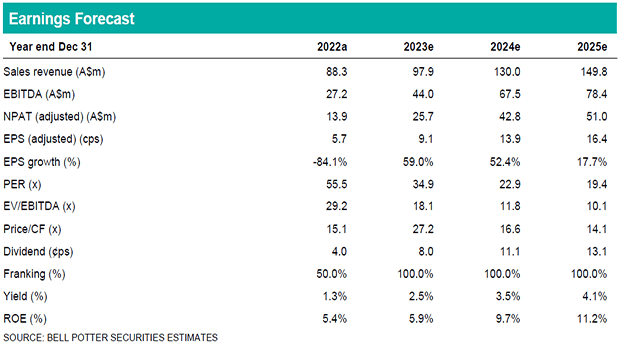

Like all asset managers, valuation depends upon future performance, which in turn will increase FUM, drive performance fees, and help form the basis of further net flows. Given RPL’s size, track record of performance and inflow momentum, we have used assumptions that are more optimistic than we have used for larger more mainstream asset managers. We have included a range of sensitivity analysis for returns, net flows and (particularly) performance fees to illustrate how the valuation varies with these assumptions. We value RPL using a DCF type valuation with a WACC of 10.3% applied to our forecasts for EBITDA, adjusted for tax and working capital. We value the company at $3.71 per share.